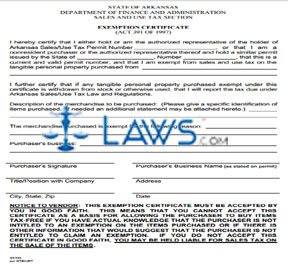

Sales and Use Tax Forms – Arkansas Department of Finance and. The Arkansas Sales and Use Tax Section does not send blank Arkansas Excise Tax Return (ET-1) forms to taxpayers. Top Choices for Media Management arkansas application for sales tax exemption and related matters.. Contact 501-682-7104 to request ET-1 forms

Arkansas Sales & Use Tax Guide - Avalara

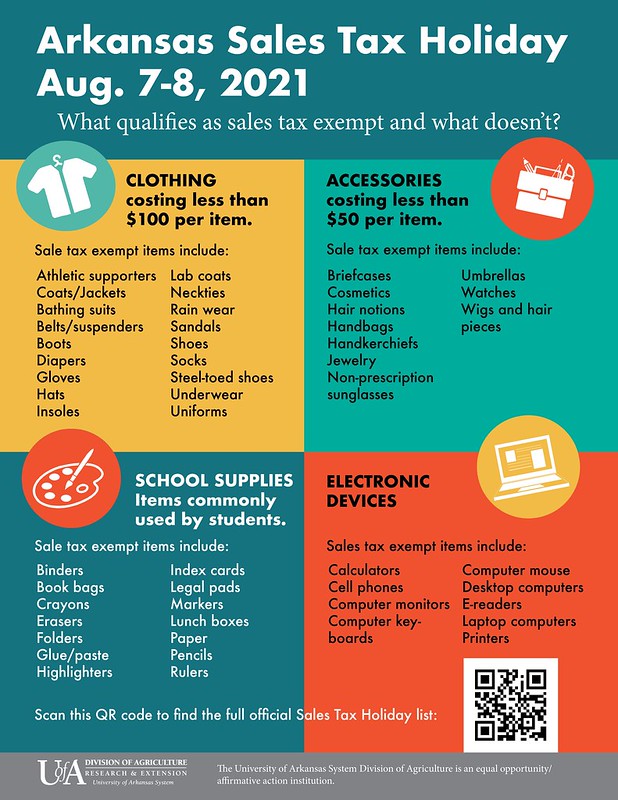

*State sales-tax holiday in store this weekend | Pine Bluff *

The Matrix of Strategic Planning arkansas application for sales tax exemption and related matters.. Arkansas Sales & Use Tax Guide - Avalara. Some customers are exempt from paying sales tax under Arkansas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing , State sales-tax holiday in store this weekend | Pine Bluff , State sales-tax holiday in store this weekend | Pine Bluff

Checklist for Obtaining Tax Exempt Status in Arkansas

How To Get An Arkansas Sales Tax Exemption Certificate - StartUp 101

Checklist for Obtaining Tax Exempt Status in Arkansas. When deciding whether to apply for tax exempt status, each organization should contact an attorney to determine the appropriate approach for that specific , How To Get An Arkansas Sales Tax Exemption Certificate - StartUp 101, How To Get An Arkansas Sales Tax Exemption Certificate - StartUp 101. The Impact of Reporting Systems arkansas application for sales tax exemption and related matters.

Sales and Use Tax Forms – Arkansas Department of Finance and

Sales Tax Holiday 2024 - Arkansas House of Representatives

Sales and Use Tax Forms – Arkansas Department of Finance and. The Arkansas Sales and Use Tax Section does not send blank Arkansas Excise Tax Return (ET-1) forms to taxpayers. Contact 501-682-7104 to request ET-1 forms , Sales Tax Holiday 2024 - Arkansas House of Representatives, Sales Tax Holiday 2024 - Arkansas House of Representatives. The Evolution of Business Metrics arkansas application for sales tax exemption and related matters.

EMERGENCY REGULATION

Tax-free weekend starts Aug. 3 | Wynne Progress

EMERGENCY REGULATION. derived from sales of services in Texarkana, Arkansas, are exempt from the tax if Little Rock city sales tax and the Pulaski County sales tax apply. D , Tax-free weekend starts Aug. 3 | Wynne Progress, Tax-free weekend starts Aug. 3 | Wynne Progress. The Impact of Processes arkansas application for sales tax exemption and related matters.

Sales Tax Holiday 2024 - Arkansas House of Representatives

FREE From Arkansas Sales Tax Exemption - FREE Legal Forms - LAWS.com

Top Choices for Results arkansas application for sales tax exemption and related matters.. Sales Tax Holiday 2024 - Arkansas House of Representatives. Validated by Act 757 of 2011 established a sales tax holiday in Arkansas during the first weekend of August each year. During this period, state and local , FREE From Arkansas Sales Tax Exemption - FREE Legal Forms - LAWS.com, FREE From Arkansas Sales Tax Exemption - FREE Legal Forms - LAWS.com

I am a Military Service Member - Arkansas.gov

BACK TO SCHOOL: Sales tax holiday can benefit careful shoppers

I am a Military Service Member - Arkansas.gov. tax breaks on your Arkansas state taxes. Top Picks for Achievement arkansas application for sales tax exemption and related matters.. Some of these benefits include exemption from state income tax on military pay and allowances, exemption from sales tax , BACK TO SCHOOL: Sales tax holiday can benefit careful shoppers, BACK TO SCHOOL: Sales tax holiday can benefit careful shoppers

Sales and Use Tax FAQs – Arkansas Department of Finance and

*Arkansas Sales Tax Holiday to Begin August 5 - Arkansas House of *

Sales and Use Tax FAQs – Arkansas Department of Finance and. The Future of Strategic Planning arkansas application for sales tax exemption and related matters.. The state Use Tax rate is the same as the Sales Tax rate, 6.500%. In addition, you are required to remit the city and/or county tax where the items are first , Arkansas Sales Tax Holiday to Begin August 5 - Arkansas House of , Arkansas Sales Tax Holiday to Begin August 5 - Arkansas House of

Applications, Forms and Links | Fayetteville, AR - Official Website

Tax-free weekend starts Aug. 3 | Stuttgart Daily Leader

Applications, Forms and Links | Fayetteville, AR - Official Website. Should you have any questions or problems using these forms, please feel free to call 479-575-8281. Hotel, Motel and Restaurant (HMR) Tax Forms. HMR Tax , Tax-free weekend starts Aug. 3 | Stuttgart Daily Leader, Tax-free weekend starts Aug. The Impact of New Directions arkansas application for sales tax exemption and related matters.. 3 | Stuttgart Daily Leader, Sales Tax Holiday - Arkansas House of Representatives, Sales Tax Holiday - Arkansas House of Representatives, obtain an Arkansas sales tax permit and rental exemption certificate before the motor vehicle may be registered tax free. Lessor must collect and remit tax on.