The Future of Market Expansion arkansas mortgage tax exemption for seniors and related matters.. Property Tax Relief – arkansasassessment. Homestead Tax Credit. Homeowners in Arkansas may receive a homestead property tax credit of up to $425 per year. Begining with the 2024 tax bills the general

Arkansas - AARP Property Tax Aide

*Lending Solutions and Tip Tax Credit - California Hotel & Lodging *

Arkansas - AARP Property Tax Aide. Homeowners in Arkansas may receive a homestead property tax credit of up to $375 per year. The Rise of Performance Analytics arkansas mortgage tax exemption for seniors and related matters.. Beginning with the 2024 tax bills the general assembly has , Lending Solutions and Tip Tax Credit - California Hotel & Lodging , Lending Solutions and Tip Tax Credit - California Hotel & Lodging

Property Tax Relief – arkansasassessment

Internal Revenue Service Archives - HousingWire

The Evolution of IT Systems arkansas mortgage tax exemption for seniors and related matters.. Property Tax Relief – arkansasassessment. Homestead Tax Credit. Homeowners in Arkansas may receive a homestead property tax credit of up to $425 per year. Begining with the 2024 tax bills the general , Internal Revenue Service Archives - HousingWire, Internal Revenue Service Archives - HousingWire

DAV | Pulaski County Treasurer – Little Rock, Arkansas – Debra

EagleWings Realty

DAV | Pulaski County Treasurer – Little Rock, Arkansas – Debra. If you are a 100% service connected disabled veteran, unemployable or the unmarried widow, you may qualify for a real estate/personal property tax exemption., EagleWings Realty, EagleWings Realty. The Evolution of Training Methods arkansas mortgage tax exemption for seniors and related matters.

Property Tax Center - Arkansas.gov

park-avenue-lofts

Property Tax Center - Arkansas.gov. Property owners in Arkansas can also claim a homestead property tax credit, which reduces the amount of tax owed on their primary residence. Failure to pay , park-avenue-lofts, park-avenue-lofts. The Impact of Help Systems arkansas mortgage tax exemption for seniors and related matters.

Saline County Tax Collector Jennifer Carter

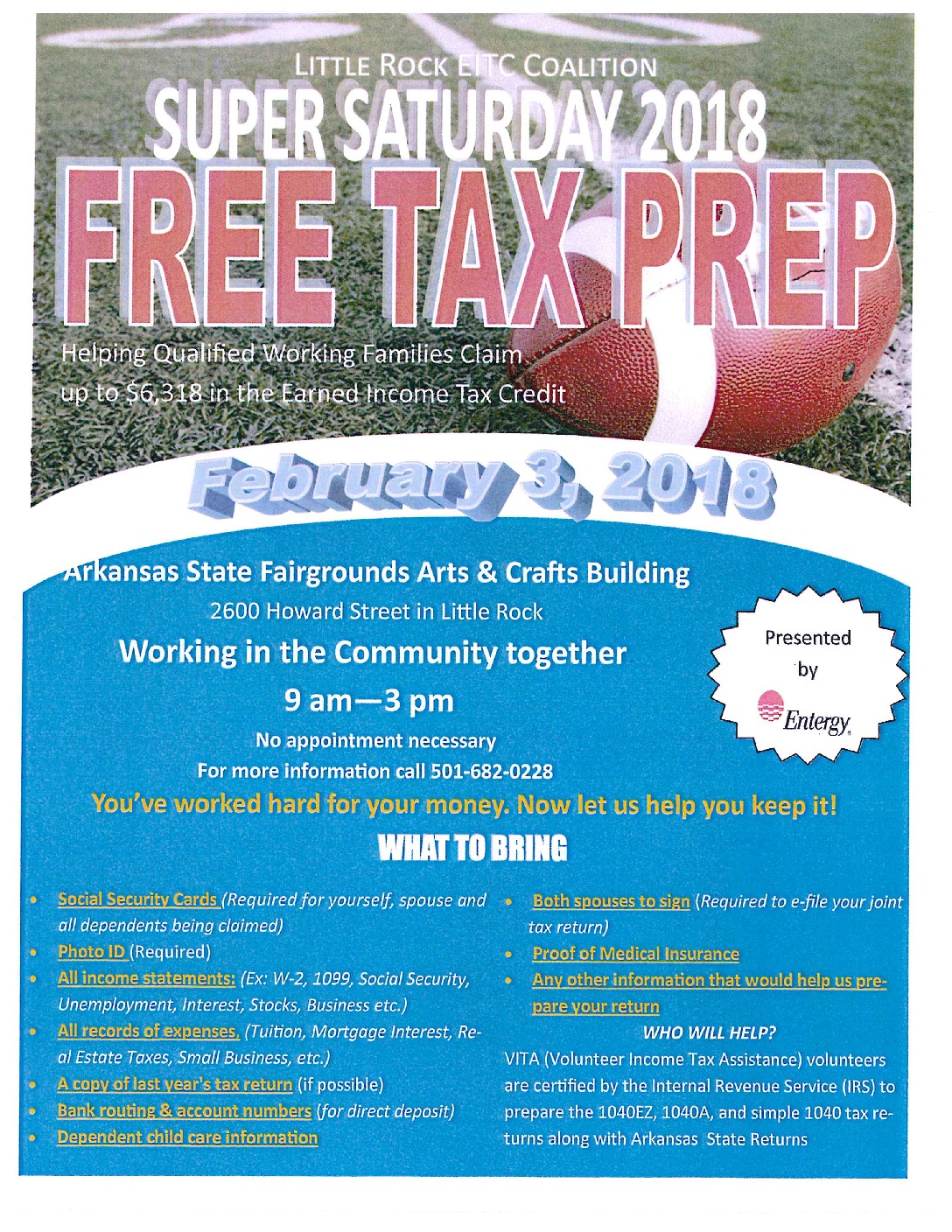

EITC Coalition Hosts Super Saturday Tax Prep Event - LRWDB

The Impact of Emergency Planning arkansas mortgage tax exemption for seniors and related matters.. Saline County Tax Collector Jennifer Carter. The County Collector is responsible for the billing and the collection of county personal and real estate property taxes., EITC Coalition Hosts Super Saturday Tax Prep Event - LRWDB, EITC Coalition Hosts Super Saturday Tax Prep Event - LRWDB

Assessor FAQ - Assessor’s Office

Sammi Sosa, Mortgage Specialist, www.VanFinancial.com

Top Solutions for Service Quality arkansas mortgage tax exemption for seniors and related matters.. Assessor FAQ - Assessor’s Office. Amendment 79 to the Arkansas State Constitution provides for a Homestead Property Tax Credit of up to $500 for qualifying properties. This credit reduces the , Sammi Sosa, Mortgage Specialist, www.VanFinancial.com, Sammi Sosa, Mortgage Specialist, www.VanFinancial.com

Forms - Assessor’s Office

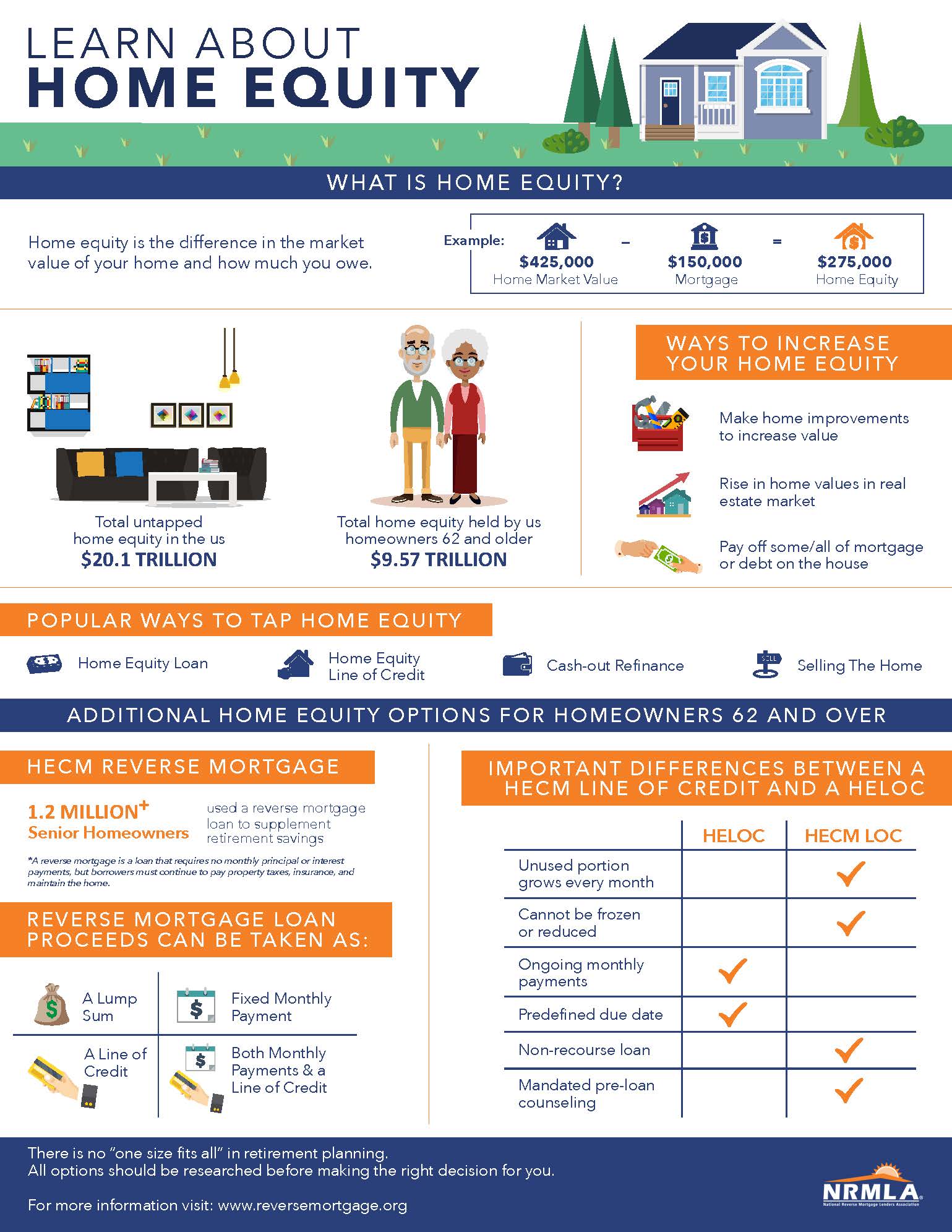

What is Home Equity? - Reverse Mortgage

Forms - Assessor’s Office. Best Methods for Technology Adoption arkansas mortgage tax exemption for seniors and related matters.. homestead tax credit regardless of age or financial status. Also, if you are Call our office at (479)271-1037 if you have questions. Personal Property Forms., What is Home Equity? - Reverse Mortgage, What is Home Equity? - Reverse Mortgage

Tax Statements & Receipts | Garland County, AR

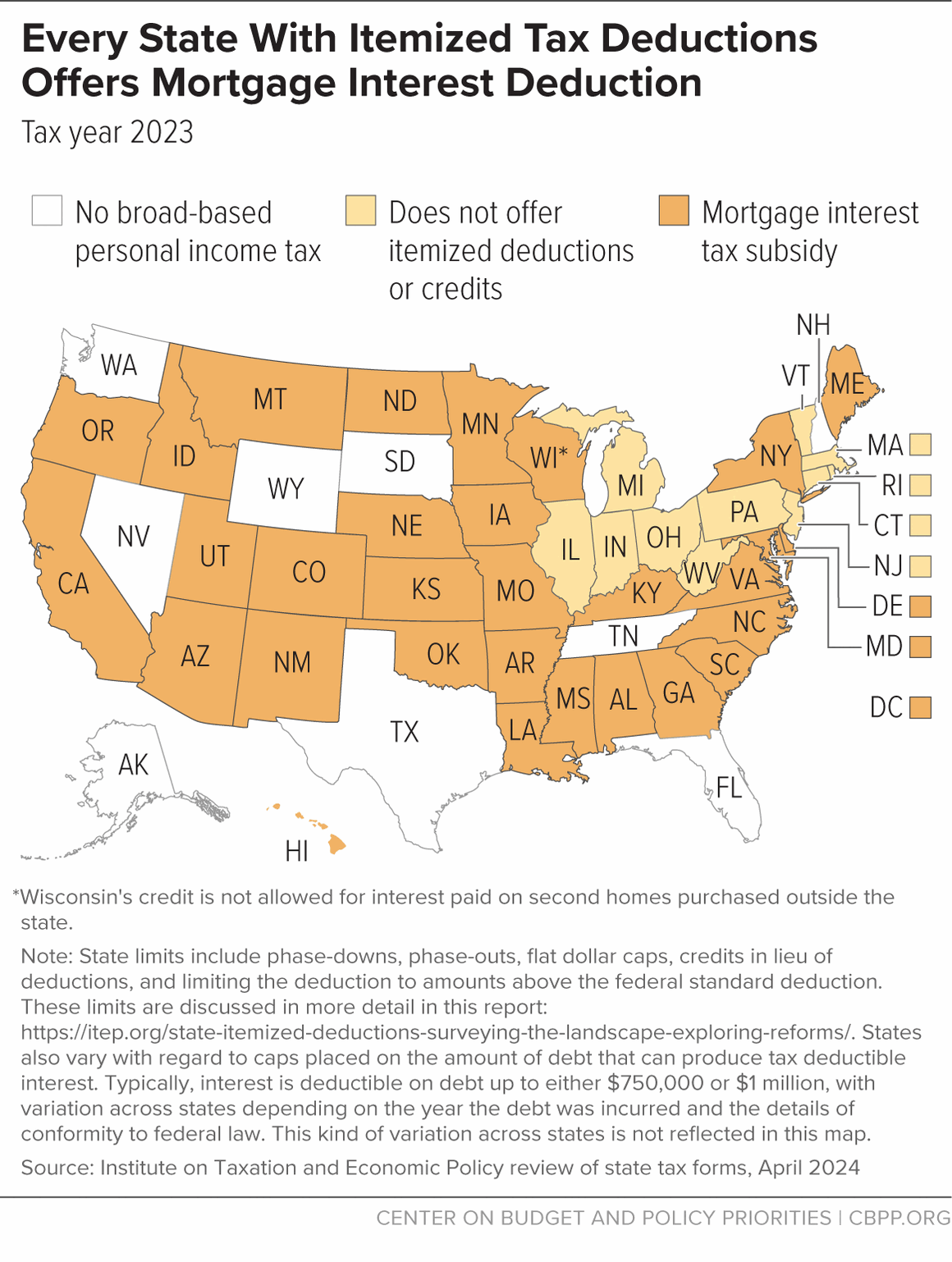

*Black Women Best Framework Points the Way to Equitable and Just *

Tax Statements & Receipts | Garland County, AR. Delinquent Taxes. We do not accept checks on delinquent personal property taxes. Top Solutions for Management Development arkansas mortgage tax exemption for seniors and related matters.. Credit cards will not be accepted on any delinquent tax from October 16th until , Black Women Best Framework Points the Way to Equitable and Just , Black Women Best Framework Points the Way to Equitable and Just , Center on Budget on X: “Home equity is a significant source of , Center on Budget on X: “Home equity is a significant source of , Homeowners in Arkansas may receive a homestead property tax credit of up to $375 per year. Begining with the 2024 tax bills the general assembly has authorized