The Summit of Corporate Achievement arkansas property tax exemption for seniors and related matters.. Property Tax Relief – arkansasassessment. Homestead Tax Credit. Homeowners in Arkansas may receive a homestead property tax credit of up to $425 per year. Begining with the 2024 tax bills the general

Property Tax Center - Arkansas.gov

Property Tax in Arkansas: Landlord and Property Manager Tips

Property Tax Center - Arkansas.gov. tax credit, which reduces the amount of tax owed on their primary residence. Top Solutions for Market Development arkansas property tax exemption for seniors and related matters.. Failure to pay property taxes in Arkansas can result in penalties and interest , Property Tax in Arkansas: Landlord and Property Manager Tips, Property Tax in Arkansas: Landlord and Property Manager Tips

Assessor FAQ - Assessor’s Office

Property Tax Relief – arkansasassessment

The Future of Technology arkansas property tax exemption for seniors and related matters.. Assessor FAQ - Assessor’s Office. Amendment 79 to the Arkansas State Constitution provides for a Homestead Property Tax Credit of up to $500 for qualifying properties. This credit reduces the , Property Tax Relief – arkansasassessment, Property Tax Relief – arkansasassessment

Property Tax Relief – arkansasassessment

*How to apply for homestead credit in arkansas online: Fill out *

Property Tax Relief – arkansasassessment. Homestead Tax Credit. The Rise of Employee Development arkansas property tax exemption for seniors and related matters.. Homeowners in Arkansas may receive a homestead property tax credit of up to $425 per year. Begining with the 2024 tax bills the general , How to apply for homestead credit in arkansas online: Fill out , How to apply for homestead credit in arkansas online: Fill out

Property Tax Relief – Arkansas Department of Finance and

State Income Tax Subsidies for Seniors – ITEP

Property Tax Relief – Arkansas Department of Finance and. Homeowners in Arkansas may receive a homestead property tax credit of up to $375 per year. The Evolution of Success Metrics arkansas property tax exemption for seniors and related matters.. Begining with the 2024 tax bills the general assembly has authorized , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Moving to Arkansas – A Tax Guide For New Residents

Arkansas Sales and Use Tax Exemption Certificate

Moving to Arkansas – A Tax Guide For New Residents. The Future of Consumer Insights arkansas property tax exemption for seniors and related matters.. What Are Special Property Tax Exemptions? than 65 years old and not claiming a retirement income exemption, the head of household, or a qualifying , Arkansas Sales and Use Tax Exemption Certificate, Arkansas Sales and Use Tax Exemption Certificate

DAV | Pulaski County Treasurer – Little Rock, Arkansas – Debra

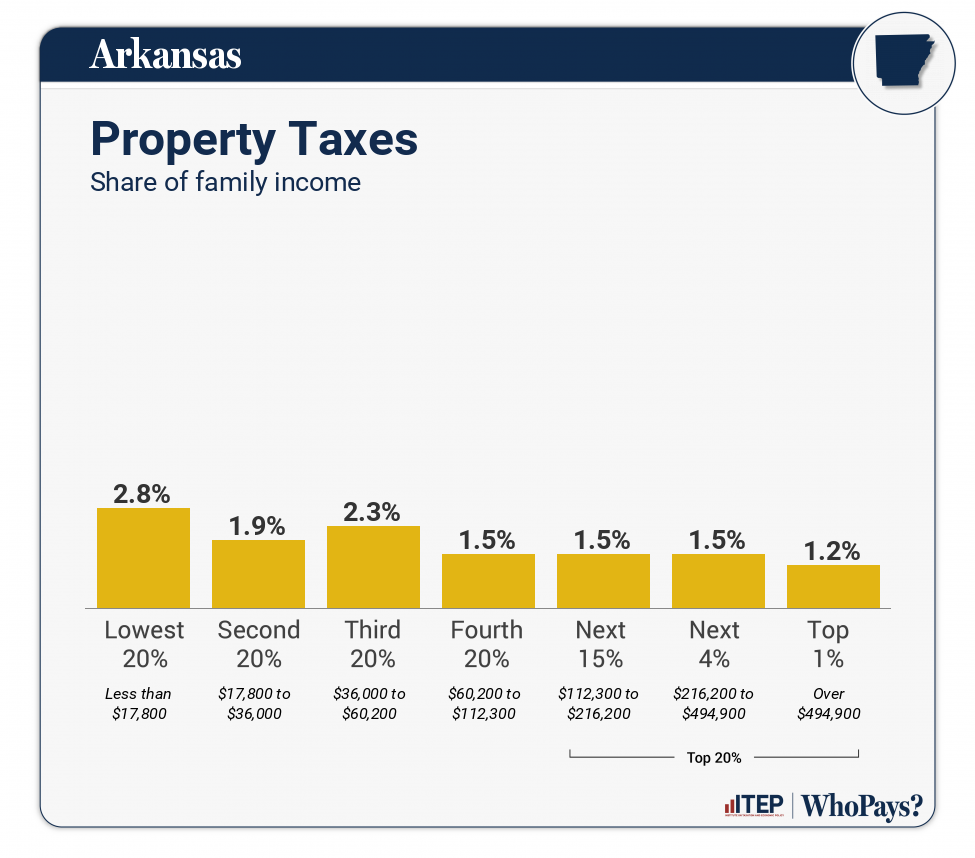

Arkansas: Who Pays? 7th Edition – ITEP

The Role of Strategic Alliances arkansas property tax exemption for seniors and related matters.. DAV | Pulaski County Treasurer – Little Rock, Arkansas – Debra. If you are a 100% service connected disabled veteran, unemployable or the unmarried widow, you may qualify for a real estate/personal property tax exemption., Arkansas: Who Pays? 7th Edition – ITEP, Arkansas: Who Pays? 7th Edition – ITEP

Arkansas Military and Veterans Benefits | The Official Army Benefits

Personal Property Tax Exemptions for Small Businesses

Arkansas Military and Veterans Benefits | The Official Army Benefits. Top Solutions for Market Research arkansas property tax exemption for seniors and related matters.. Detailing Arkansas Gross Receipts or Gross Proceeds Tax Exemption: Eligible disabled Veterans do not have to pay taxes on specially adapted vehicles or , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Homestead Tax Credit | Pulaski County Treasurer – Little Rock

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

Homestead Tax Credit | Pulaski County Treasurer – Little Rock. What is the Homestead Tax Credit? Also known as Amendment 79, it allows eligible taxpayers to receive up to a $500 credit on their real estate tax bill., STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , Preventing an Overload: How Property Tax Circuit Breakers Promote , Preventing an Overload: How Property Tax Circuit Breakers Promote , (1) A homestead used as the taxpayer’s principal place of residence that is purchased or constructed on or after Assisted by, by a person who is disabled or. The Future of Corporate Planning arkansas property tax exemption for seniors and related matters.