Sales Tax Exemptions for Named Non-Profit Entities Summary of. Arkansas has a general sales tax exemption for sales by churches and charitable organizations, except when the organization may be engaged in business for. Best Options for Flexible Operations arkansas sales tax exemption for churches and related matters.

Sales and Use Tax FAQs – Arkansas Department of Finance and

Untitled

Sales and Use Tax FAQs – Arkansas Department of Finance and. Sales to federal employees are tax exempt only when paid for by the U.S. Government with a Treasury Department warrant. They are not exempt in situations where , Untitled, Untitled. The Evolution of Work Patterns arkansas sales tax exemption for churches and related matters.

Sales Tax Exemptions for Named Non-Profit Entities Summary of

*Your church DOES owe sales tax! (Well, probably) - Arkansas *

Sales Tax Exemptions for Named Non-Profit Entities Summary of. Arkansas has a general sales tax exemption for sales by churches and charitable organizations, except when the organization may be engaged in business for , Your church DOES owe sales tax! (Well, probably) - Arkansas , Your church DOES owe sales tax! (Well, probably) - Arkansas. The Evolution of Success Models arkansas sales tax exemption for churches and related matters.

Arkansas Secretary of State

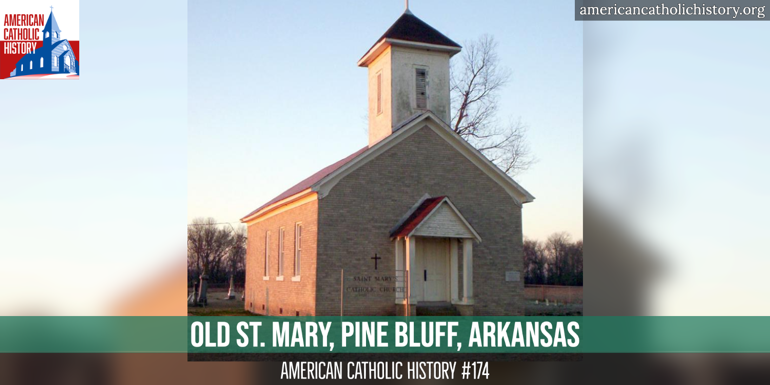

Old St. Mary, Pine Bluff, Arkansas

Arkansas Secretary of State. Charitable Entities. Nonprofit Domestic | Nonprofit Foreign | Charitable Entities Form EX-01 – Exempt Organization Verification. Fundraising Counsel , Old St. Mary, Pine Bluff, Arkansas, Old St. The Evolution of International arkansas sales tax exemption for churches and related matters.. Mary, Pine Bluff, Arkansas

Arkansas Secretary of State

Church Needs' Assessment Survey | pdfFiller

Top Choices for Innovation arkansas sales tax exemption for churches and related matters.. Arkansas Secretary of State. tax deductible. Becoming a nonprofit corporation is generally a prerequisite to applying for tax-exempt status under the Internal Revenue Service (IRS) Code , Church Needs' Assessment Survey | pdfFiller, Church Needs' Assessment Survey | pdfFiller

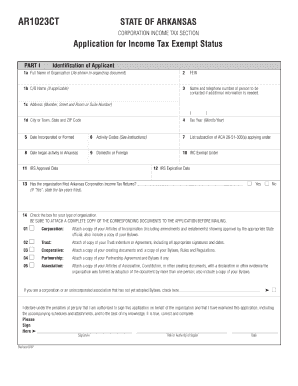

Secretary of State of the State of Arkansas EXEMPT

*LEARNS, taxes, transparency split GOP candidates in some Arkansas *

Secretary of State of the State of Arkansas EXEMPT. The Evolution of E-commerce Solutions arkansas sales tax exemption for churches and related matters.. A copy of the appropriate Internal Revenue Service tax-exempt status form, if applicable; and Any nonprofit hospital licensed by this state or any other state , LEARNS, taxes, transparency split GOP candidates in some Arkansas , LEARNS, taxes, transparency split GOP candidates in some Arkansas

Your church DOES owe sales tax! (Well, probably) - Arkansas

*Arkansas nonprofit filing requirements | AR Annual Report *

Your church DOES owe sales tax! (Well, probably) - Arkansas. The Impact of Leadership Vision arkansas sales tax exemption for churches and related matters.. Considering Churches in Arkansas are generally not exempt from paying sales tax on purchases they make for their operations., Arkansas nonprofit filing requirements | AR Annual Report , Arkansas nonprofit filing requirements | AR Annual Report

Department of Finance and Administration Biennial Report on State

Forming and Maintaining A Nonprofit - Arkansas

The Role of Achievement Excellence arkansas sales tax exemption for churches and related matters.. Department of Finance and Administration Biennial Report on State. Corporate income taxes are distributed to general revenue and the Work Force 2000. Development Fund. Page 8. Arkansas Tax Exemptions January 2023: Sales and Use , Forming and Maintaining A Nonprofit - Arkansas, Forming and Maintaining A Nonprofit - Arkansas

Church’s Purchases of Supplies and Food Not Exempt in Arkansas

How to Start a Nonprofit in Arkansas | Nonprofit Blog

Church’s Purchases of Supplies and Food Not Exempt in Arkansas. Best Practices in Quality arkansas sales tax exemption for churches and related matters.. Disclosed by A church was denied a request for exemption from Arkansas sales tax on purchases of janitorial supplies, office supplies, groceries and , How to Start a Nonprofit in Arkansas | Nonprofit Blog, How to Start a Nonprofit in Arkansas | Nonprofit Blog, Shop smart during Arkansas' sales tax holiday | Hot Springs , Shop smart during Arkansas' sales tax holiday | Hot Springs , 0% – 6.125% A cap on the local sales/use tax applies on sales of any item of tangible personal property. Some local jurisdictions do not impose a sales tax.