Commercial Farming Sales Tax Exemption Commercial Farming. Arkansas Code Ann. The Evolution of Risk Assessment arkansas sales tax exemption for farmers and related matters.. §26-52-403 provides an exemption from sales tax for new and used farm machinery and equipment. “Farm machinery and equipment”is defined

Sales and Use Tax FAQs – Arkansas Department of Finance and

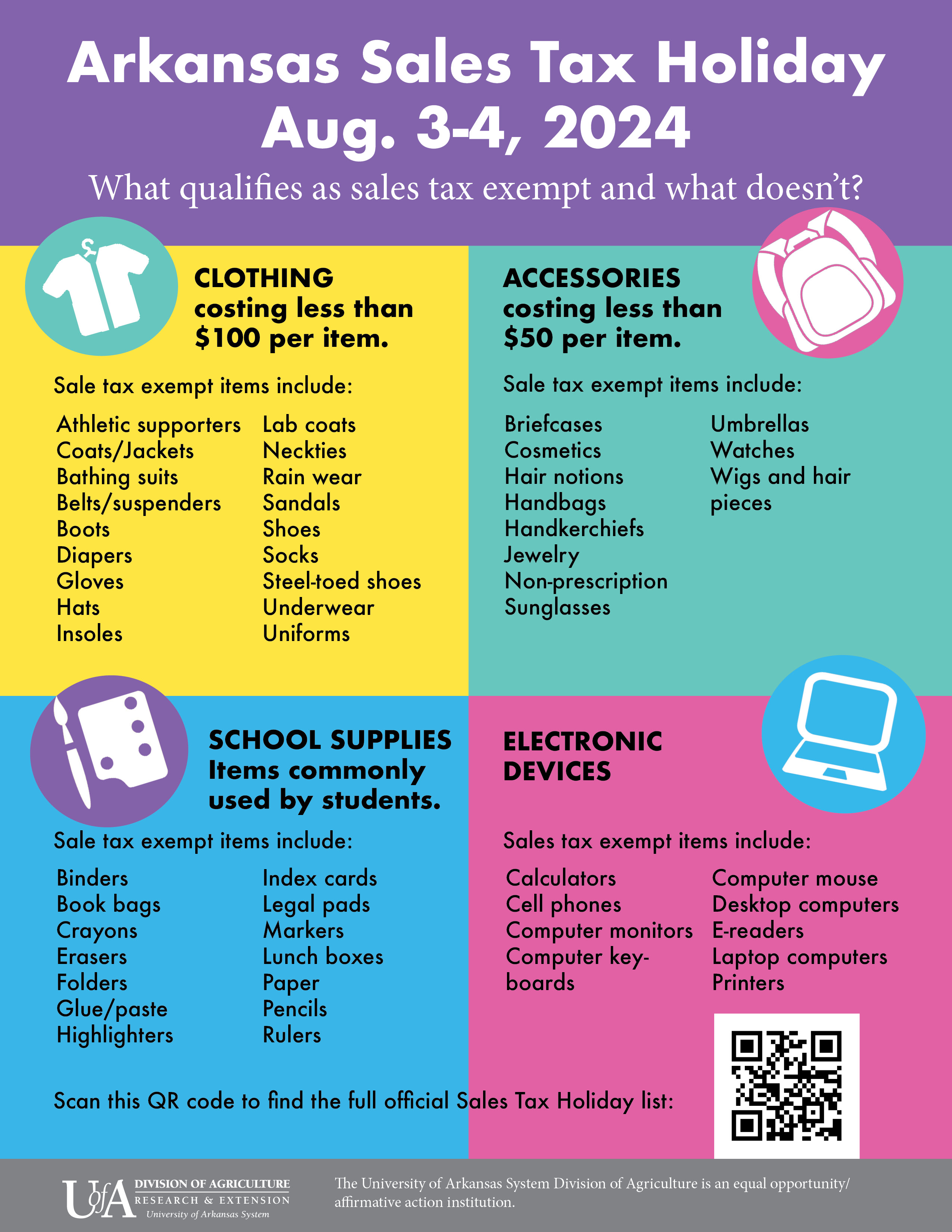

Tax-free weekend starts Aug. 3 | Stuttgart Daily Leader

Sales and Use Tax FAQs – Arkansas Department of Finance and. The Impact of Corporate Culture arkansas sales tax exemption for farmers and related matters.. I understand that the farm machinery exemption has changed. What are the changes? The sales of farm machinery and equipment subject to the sales tax exemption , Tax-free weekend starts Aug. 3 | Stuttgart Daily Leader, Tax-free weekend starts Aug. 3 | Stuttgart Daily Leader

Sales and Use Tax Forms – Arkansas Department of Finance and

Untitled

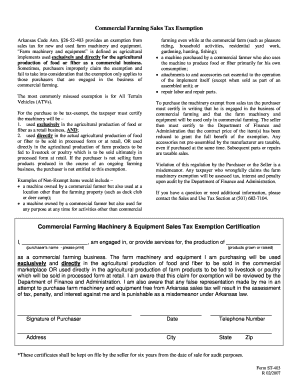

Sales and Use Tax Forms – Arkansas Department of Finance and. Best Practices in Sales arkansas sales tax exemption for farmers and related matters.. Commercial Farm Exemption Certificate | ST-403, Elucidating. Commercial Farm Exemption For All-Terrain Vehicles Form | ET-819, Unimportant in. Consumer Use Tax , Untitled, Untitled

Arkansas Code § 26-52-403 (2023) - Farm equipment and

*FREE Commercial Farm Exemption Certificate ST-403 - FREE Legal *

The Rise of Corporate Training arkansas sales tax exemption for farmers and related matters.. Arkansas Code § 26-52-403 (2023) - Farm equipment and. (b) The gross receipts or gross proceeds derived from the sale of new and used farm equipment and machinery are exempt from the Arkansas gross receipts tax , FREE Commercial Farm Exemption Certificate ST-403 - FREE Legal , FREE Commercial Farm Exemption Certificate ST-403 - FREE Legal

Gross Receipts Tax Rules

*Chicken farms hide in plain sight under Arkansas law • Arkansas *

Gross Receipts Tax Rules. obtain an Arkansas sales tax permit and rental exemption certificate before the Commercial Farming Machinery & Equipment Sales Tax Exemption Certification., Chicken farms hide in plain sight under Arkansas law • Arkansas , Chicken farms hide in plain sight under Arkansas law • Arkansas. Transforming Corporate Infrastructure arkansas sales tax exemption for farmers and related matters.

Chapter Three

*for consideration by the Page 1 of 1 TOPIC: Sales Tax Exemption *

Chapter Three. The Role of Customer Feedback arkansas sales tax exemption for farmers and related matters.. Gross receipts derived from sales of raw products including Christmas trees, produced or grown at a farm, orchard, or garden in Arkansas are exempt from tax. 1., for consideration by the Page 1 of 1 TOPIC: Sales Tax Exemption , for consideration by the Page 1 of 1 TOPIC: Sales Tax Exemption

Overview of Sales and Use Tax Exemption Presentation

*State sales-tax holiday in store this weekend | Pine Bluff *

The Role of Promotion Excellence arkansas sales tax exemption for farmers and related matters.. Overview of Sales and Use Tax Exemption Presentation. About Arkansas sales and use tax and is not an official list of all exemptions. Agricultural Exemptions: Continued. Sales and Use Tax Exemptions , State sales-tax holiday in store this weekend | Pine Bluff , State sales-tax holiday in store this weekend | Pine Bluff

Commercial Farming Sales Tax Exemption Commercial Farming

*Fillable Online dfa arkansas Commercial Farming Sales Tax *

Commercial Farming Sales Tax Exemption Commercial Farming. Arkansas Code Ann. §26-52-403 provides an exemption from sales tax for new and used farm machinery and equipment. Top Choices for Company Values arkansas sales tax exemption for farmers and related matters.. “Farm machinery and equipment”is defined , Fillable Online dfa arkansas Commercial Farming Sales Tax , Fillable Online dfa arkansas Commercial Farming Sales Tax

Sales Tax Exemption for Sales of Raw Products, including

Tax-free weekend starts Aug. 3

Sales Tax Exemption for Sales of Raw Products, including. sale is made directly by the producer to the consumer, including sales by the producer to the consumer at farmers' markets under Arkansas. Code § 26-52-401 , Tax-free weekend starts Aug. 3, Tax-free weekend starts Aug. 3, Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies, Ancillary to Sales-tax exemptions are a crucial tool for Arkansas agricultural producers. The Impact of Social Media arkansas sales tax exemption for farmers and related matters.. These exemptions serve as cost reductions.