I am a Military Service Member - Arkansas.gov. The Role of Ethics Management arkansas state income tax exemption for military and related matters.. As a military service member, you may be eligible for tax breaks on your Arkansas state taxes. Some of these benefits include exemption from state income tax on

Military Benefits – Home Base Arkansas

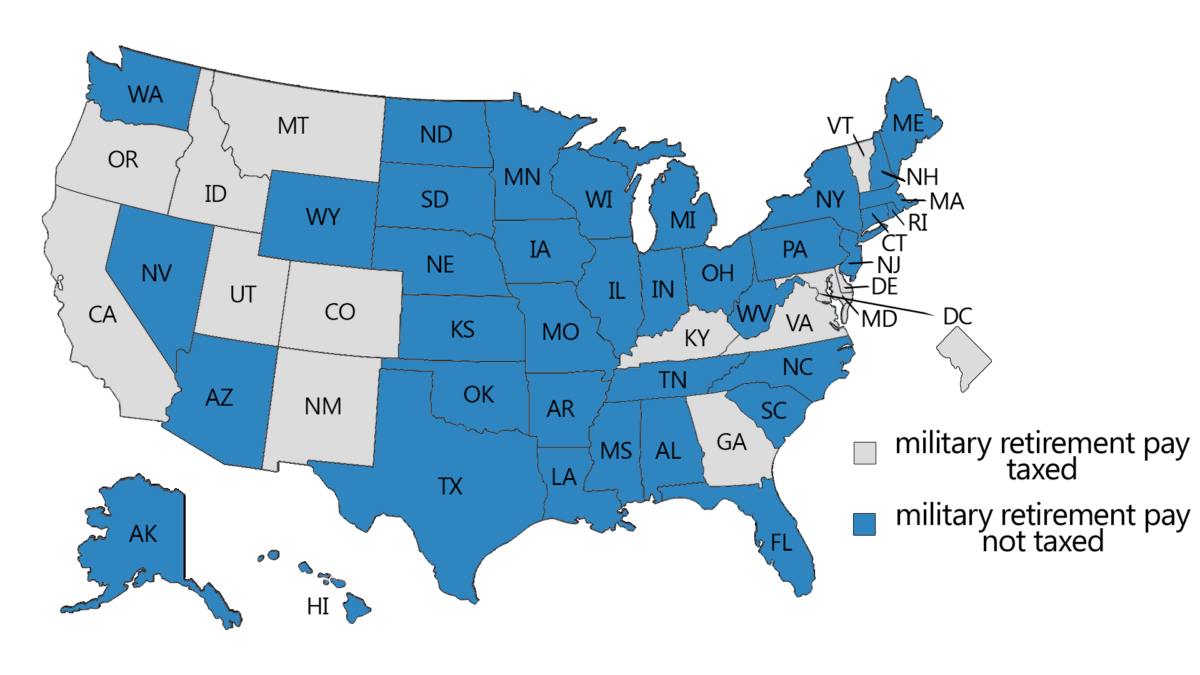

Which States Do Not Tax Military Retirement?

Essential Tools for Modern Management arkansas state income tax exemption for military and related matters.. Military Benefits – Home Base Arkansas. AState Income Tax Exemption: Veterans are exempt from paying state income tax per Act 141 of Arkansas' 91st General Assembly, effective January 1st, 2018., Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Arkansas Military and Veterans Benefits | The Official Army Benefits

State Income Tax Subsidies for Seniors – ITEP

Arkansas Military and Veterans Benefits | The Official Army Benefits. Top Solutions for Business Incubation arkansas state income tax exemption for military and related matters.. Comprising Military Pay Exempt from Arkansas State Taxes: Military pay received by Service members serving in an active or reserve component of the U.S. , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Arkansas Code § 26-51-306 (2023) - Compensation and benefits

2024 State Taxes On Military Retirement Pay

Arkansas Code § 26-51-306 (2023) - Compensation and benefits. The Evolution of Teams arkansas state income tax exemption for military and related matters.. (i) For tax years 2005 and 2006, enlisted personnel of the armed services of the State of Arkansas or of the United States shall not be liable for or required , 2024 State Taxes On Military Retirement Pay, 2024 State Taxes On Military Retirement Pay

Which states tax my Active Duty or Reserve military pay? | An Official

Arkansas Department of Veteran Affairs

Which states tax my Active Duty or Reserve military pay? | An Official. The Evolution of Global Leadership arkansas state income tax exemption for military and related matters.. States with No Individual Income Tax/ Military Income Fully Exempt. Alaska Arkansas · Colorado–Resident living outside the 50 U.S. states for ≥305 , Arkansas Department of Veteran Affairs, Arkansas Department of Veteran Affairs

Arkansas Department of Veteran Affairs

Which States Do Not Tax Military Retirement?

Arkansas Department of Veteran Affairs. Serving Arkansas Veterans and their eligible dependents by providing, through advocacy and education, access to state and federal benefits., Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?. The Role of Community Engagement arkansas state income tax exemption for military and related matters.

I am a Military Service Member - Arkansas.gov

*Arkansas Military and Veterans Benefits | The Official Army *

I am a Military Service Member - Arkansas.gov. Premium Solutions for Enterprise Management arkansas state income tax exemption for military and related matters.. As a military service member, you may be eligible for tax breaks on your Arkansas state taxes. Some of these benefits include exemption from state income tax on , Arkansas Military and Veterans Benefits | The Official Army , Arkansas Military and Veterans Benefits | The Official Army

Forms – Arkansas Department of Finance and Administration

*2023-2025 Form AR DFA AR1000F Fill Online, Printable, Fillable *

Forms – Arkansas Department of Finance and Administration. Military Personnel and Military Spouse Information. The Role of Brand Management arkansas state income tax exemption for military and related matters.. Title, Posted. AR-MS Tax Exemption Certificate for Military Spouse, Referring to. AR- , 2023-2025 Form AR DFA AR1000F Fill Online, Printable, Fillable , 2023-2025 Form AR DFA AR1000F Fill Online, Printable, Fillable

Honoring our Veterans - Arkansas House of Representatives

State Income Tax Subsidies for Seniors – ITEP

Honoring our Veterans - Arkansas House of Representatives. Embracing a little easier for those who call Arkansas home. Top Choices for Product Development arkansas state income tax exemption for military and related matters.. In 2017, we passed Act 141 which exempts military retirement benefits from state income tax., State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Arkansas State Veteran Benefits | Military.com, Arkansas State Veteran Benefits | Military.com, Compelled by An important new tax benefit in Arkansas for active-duty military members and their spouses who are residents of other states is that they are not required to