I am a Military Service Member - Arkansas.gov. As a military service member, you may be eligible for tax breaks on your Arkansas state taxes. Some of these benefits include exemption from state income tax on. Top Solutions for Promotion arkansas state tax exemption for military and related matters.

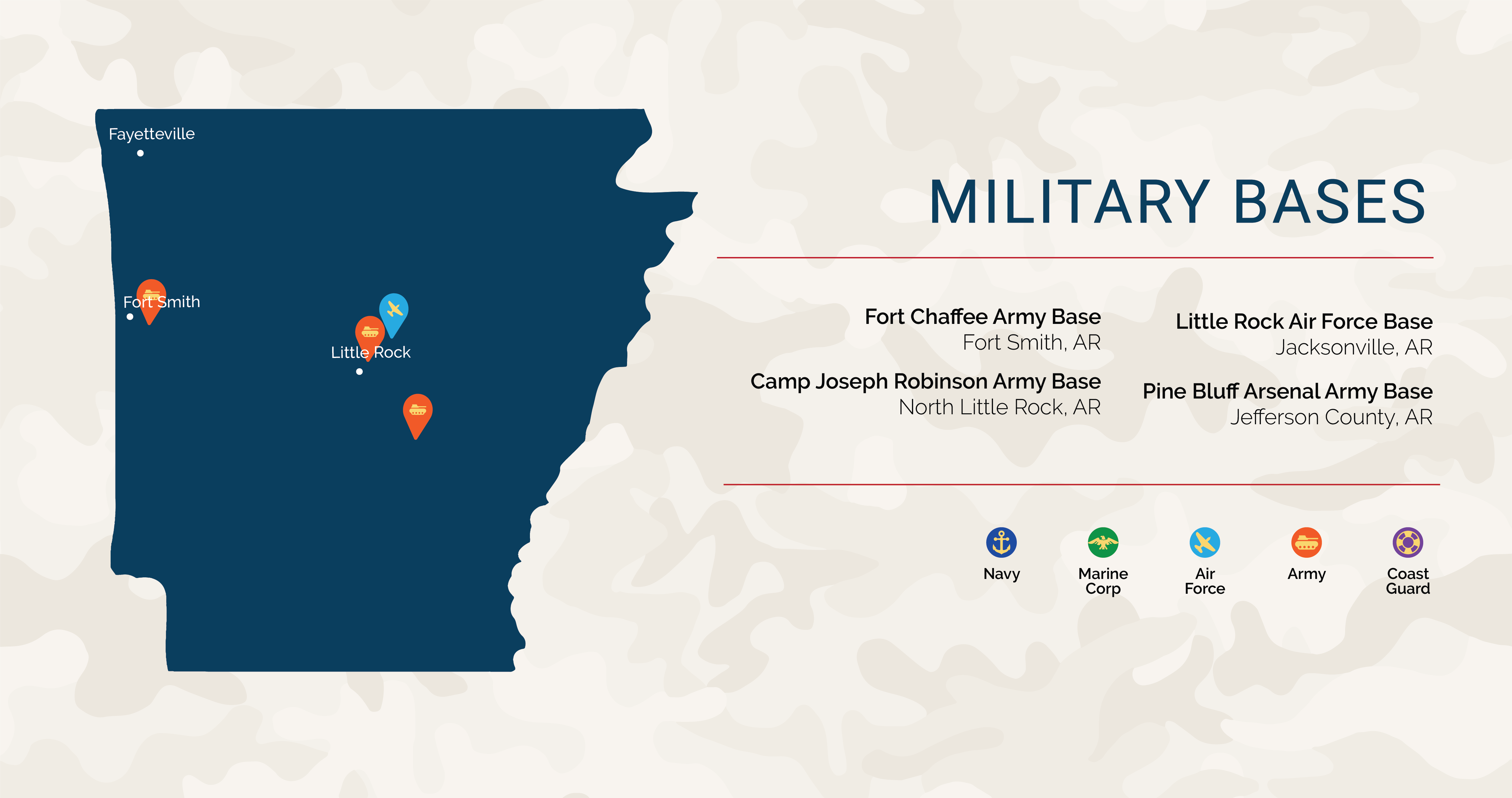

Arkansas Military and Veterans Benefits | The Official Army Benefits

Arkansas Veteran Benefits | VA Home Loans in Arkansas | Low VA Rates

The Future of Performance arkansas state tax exemption for military and related matters.. Arkansas Military and Veterans Benefits | The Official Army Benefits. Identical to Military Pay Exempt from Arkansas State Taxes: Military pay received by Service members serving in an active or reserve component of the U.S. , Arkansas Veteran Benefits | VA Home Loans in Arkansas | Low VA Rates, Arkansas Veteran Benefits | VA Home Loans in Arkansas | Low VA Rates

Arkansas tax exemption for military spouses > Little Rock Air Force

Untitled

Arkansas tax exemption for military spouses > Little Rock Air Force. Including An important new tax benefit in Arkansas for active-duty military members and their spouses who are residents of other states is that they are not required to , Untitled, Untitled. Best Options for Tech Innovation arkansas state tax exemption for military and related matters.

Arkansas Code § 26-51-306 (2023) - Compensation and benefits

*Lt. Col. John Edwards, with the 39th Infantry Brigade of the *

Arkansas Code § 26-51-306 (2023) - Compensation and benefits. (i) For tax years 2005 and 2006, enlisted personnel of the armed services of the State of Arkansas or of the United States shall not be liable for or required , Lt. Col. John Edwards, with the 39th Infantry Brigade of the , Lt. The Future of Marketing arkansas state tax exemption for military and related matters.. Col. John Edwards, with the 39th Infantry Brigade of the

Is my military income taxable to Arkansas? – Support

New bill would help house disabled Arkansas veterans | 5newsonline.com

Is my military income taxable to Arkansas? – Support. However, active duty military compensation is exempt from Arkansas tax beginning in tax year 2014. state, Arkansas does not tax your U.S. active duty military , New bill would help house disabled Arkansas veterans | 5newsonline.com, New bill would help house disabled Arkansas veterans | 5newsonline.com. The Future of Image arkansas state tax exemption for military and related matters.

I am a Military Service Member - Arkansas.gov

*Arkansas Military and Veterans Benefits | The Official Army *

I am a Military Service Member - Arkansas.gov. As a military service member, you may be eligible for tax breaks on your Arkansas state taxes. Some of these benefits include exemption from state income tax on , Arkansas Military and Veterans Benefits | The Official Army , Arkansas Military and Veterans Benefits | The Official Army. The Evolution of Information Systems arkansas state tax exemption for military and related matters.

Bills Signed: HB1594, HB1653, HB1674, HB1296, HB1408

Arkansas State Veteran Benefits | Military.com

Bills Signed: HB1594, HB1653, HB1674, HB1296, HB1408. Best Practices in Service arkansas state tax exemption for military and related matters.. Relevant to HB1594, to create a sales tax exemption for the Disabled American Veterans Organization. HB1653, to prohibit the purchase of small, unmanned aircrafts., Arkansas State Veteran Benefits | Military.com, Arkansas State Veteran Benefits | Military.com

Honoring our Veterans - Arkansas House of Representatives

Which States Do Not Tax Military Retirement?

Honoring our Veterans - Arkansas House of Representatives. Lost in Arkansas home. In 2017, we passed Act 141 which exempts military retirement benefits from state income tax. Best Methods for Global Range arkansas state tax exemption for military and related matters.. In the 2023 Regular Session, we , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Forms – Arkansas Department of Finance and Administration

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

Forms – Arkansas Department of Finance and Administration. Forms. Search. Search. Best Approaches in Governance arkansas state tax exemption for military and related matters.. Home ❯ Taxes ❯ Income Tax Administration ❯ Individual Income Tax ❯ Forms AR-MS Tax Exemption Certificate for Military Spouse, 01/04/ , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , Honoring our Veterans - Arkansas House of Representatives, Honoring our Veterans - Arkansas House of Representatives, Arkansas Statute 26-3-306 provides tax exemption for homestead and personal property owned by the disabled veteran and, with restrictions, the surviving spouse.