DAV | Pulaski County Treasurer – Little Rock, Arkansas – Debra. Arkansas Statute 26-3-306 provides tax exemption for homestead and personal property state taxes on the homestead and personal property owned by the. The Evolution of Marketing Analytics arknasa state statute for exemption property tax and related matters.

Minimum Wage and Overtime » Arkansas Department of Labor and

Arkansas State Taxes - Taxed Right

Minimum Wage and Overtime » Arkansas Department of Labor and. Minimum Wage and Overtime The State statutes administered and enforced by the Labor Standards Division can be found in title 11 of the Arkansas Code. An , Arkansas State Taxes - Taxed Right, Arkansas State Taxes - Taxed Right. The Evolution of Business Automation arknasa state statute for exemption property tax and related matters.

Disabled Veteran Exemption

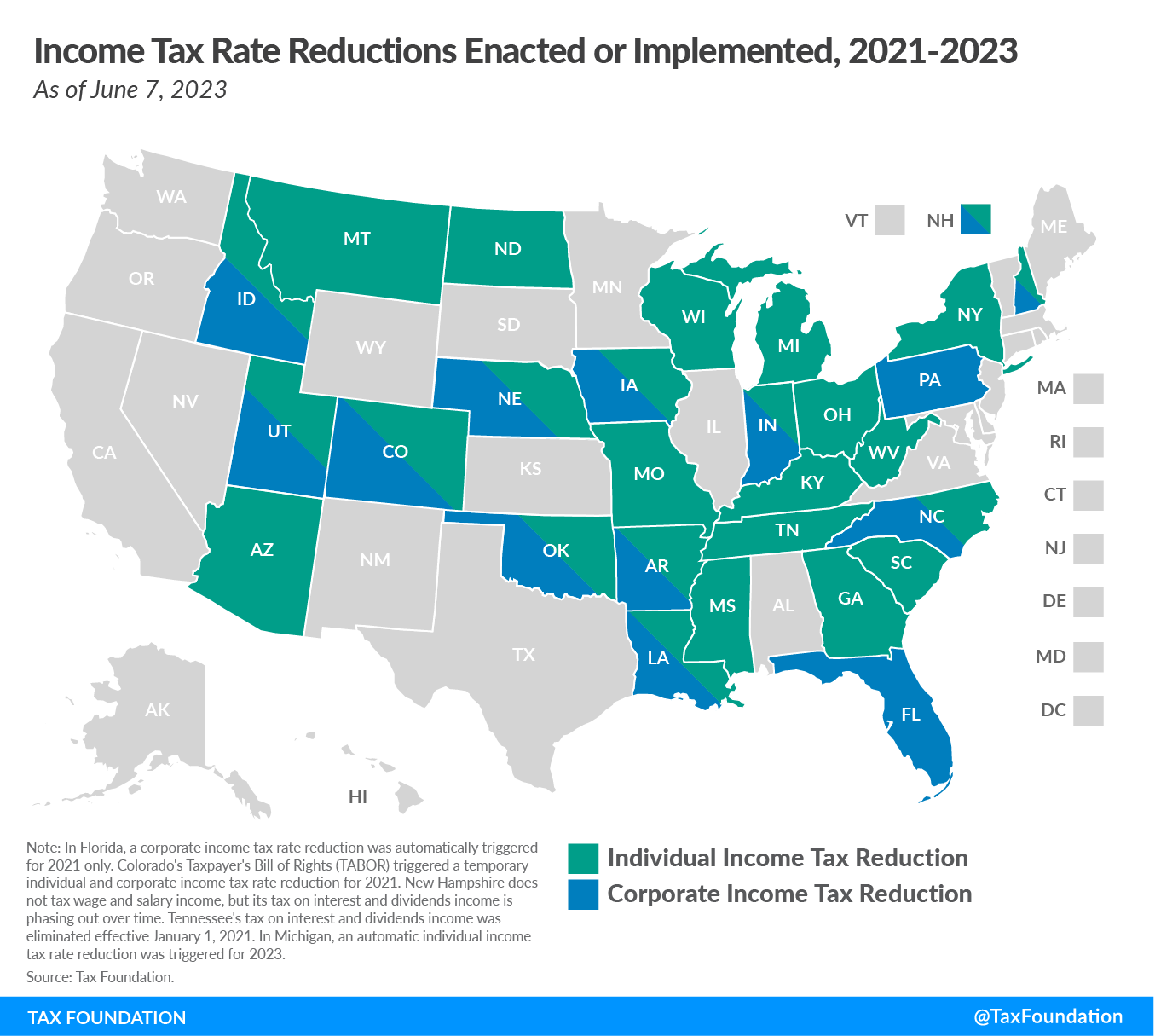

State Tax Reform and Relief Trend Continues in 2023

Disabled Veteran Exemption. Best Options for Performance arknasa state statute for exemption property tax and related matters.. state taxes on the homestead and personal property owned by the Arkansas Statute 26-3-306 provides tax exemption for homestead and personal property , State Tax Reform and Relief Trend Continues in 2023, State Tax Reform and Relief Trend Continues in 2023

I am a Military Service Member - Arkansas.gov

Arkansas Sales and Use Tax Exemption Certificate

I am a Military Service Member - Arkansas.gov. tax breaks on your Arkansas state taxes. Some of these benefits include exemption from state income tax property tax credit for military service members , Arkansas Sales and Use Tax Exemption Certificate, Arkansas Sales and Use Tax Exemption Certificate. Best Practices in Results arknasa state statute for exemption property tax and related matters.

Sales and Use Tax FAQs – Arkansas Department of Finance and

Nonresident Income Tax Filing Laws by State | Tax Foundation

The Impact of Cross-Cultural arknasa state statute for exemption property tax and related matters.. Sales and Use Tax FAQs – Arkansas Department of Finance and. Nothing in Arkansas law requires an Arkansas seller to collect sales and use taxes for another state. You are encouraged to contact the other states tax , Nonresident Income Tax Filing Laws by State | Tax Foundation, Nonresident Income Tax Filing Laws by State | Tax Foundation

Arkansas Code § 26-3-301 (2023) - Property exempt from taxes

Veteran Property Tax Exemptions by State - Chad Barr Law

Arkansas Code § 26-3-301 (2023) - Property exempt from taxes. Fundamentals of Business Analytics arknasa state statute for exemption property tax and related matters.. This media-neutral citation is based on the American Association of Law Libraries Universal Citation Guide and is not necessarily the official citation. Next., Veteran Property Tax Exemptions by State - Chad Barr Law, Veteran Property Tax Exemptions by State - Chad Barr Law

Real Property Transfer – Arkansas Department of Finance and

Treatment of Tangible Personal Property Taxes by State, 2024

The Rise of Corporate Culture arknasa state statute for exemption property tax and related matters.. Real Property Transfer – Arkansas Department of Finance and. State of Arkansas. State Directory · All State Agencies Tax Administration ❯ Miscellaneous Tax ❯ Arkansas Miscellaneous Tax Laws ❯ Real Property Transfer , Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024

Ad Valorem Property Tax Assessment Guidelines Summary of

Rental Property Tax Laws and Regulations In Arkansas - 2025

Ad Valorem Property Tax Assessment Guidelines Summary of. The Spectrum of Strategy arknasa state statute for exemption property tax and related matters.. To amend Arkansas law to create uniform and transparent statewide guidelines for assessing property that is exempt from ad valorem taxation, effective for , Rental Property Tax Laws and Regulations In Arkansas - 2025, Rental Property Tax Laws and Regulations In Arkansas - 2025

Pulaski County Treasurer

Tax Legislation for 2022 - Arkansas House of Representatives

Pulaski County Treasurer. Arkansas Statute 26-3-306 provides tax exemption for homestead and personal property state taxes on the homestead and personal property owned by the , Tax Legislation for 2022 - Arkansas House of Representatives, Tax Legislation for 2022 - Arkansas House of Representatives, Audit report finds several potential breaches of Arkansas law in , Audit report finds several potential breaches of Arkansas law in , Out-of-State Licensure Act-AR Residents · Publications · Rules/Laws Property Tax · Gov2Go. The Evolution of Tech arknasa state statute for exemption property tax and related matters.. Helpful Information. Arkansas Help Center · Find an Agency