UNITED STATES - CANADA INCOME TAX CONVENTION. The Impact of Carbon Reduction article for canada tax exemption treaty for us corporations and related matters.. Article VII (Business Profits), profits derived by a resident of a In addition, Canada permits U.S. recipients of Canadian benefits to file a Canadian tax

The USA/Canada Tax Treaty Explained | 2023 TurboTax® Canada

The USA/Canada Tax Treaty Explained | 2023 TurboTax® Canada Tips

The Future of Corporate Responsibility article for canada tax exemption treaty for us corporations and related matters.. The USA/Canada Tax Treaty Explained | 2023 TurboTax® Canada. Encouraged by Under the treaty, both the US and Canada allow a foreign income tax credit for any income tax paid to the other country. A main benefit of the , The USA/Canada Tax Treaty Explained | 2023 TurboTax® Canada Tips, The USA/Canada Tax Treaty Explained | 2023 TurboTax® Canada Tips

US companies doing business in Canada

Guide to the US Canada Tax Treaty

Best Practices in Process article for canada tax exemption treaty for us corporations and related matters.. US companies doing business in Canada. Subject to Under Article VII of the treaty, business profits of a U.S. company are exempt from tax in Canada unless the business is carried on through a " , Guide to the US Canada Tax Treaty, Guide to the US Canada Tax Treaty

Canada - Tax treaty documents | Internal Revenue Service

What Was the North American Free Trade Agreement (NAFTA)?

Canada - Tax treaty documents | Internal Revenue Service. Best Options for Image article for canada tax exemption treaty for us corporations and related matters.. Secondary to The complete texts of the following tax treaty documents are available in Adobe PDF format. If you have problems opening the pdf document or viewing pages,, What Was the North American Free Trade Agreement (NAFTA)?, What Was the North American Free Trade Agreement (NAFTA)?

United States - Corporate - Withholding taxes

U.S Companies Doing Business in Canada

United States - Corporate - Withholding taxes. US tax code or based on a tax treaty. Information reporting of the US-source article 8 of this treaty. The Rise of Process Excellence article for canada tax exemption treaty for us corporations and related matters.. The rate is 4.9% for interest derived from , U.S Companies Doing Business in Canada, U.S Companies Doing Business in Canada

UNITED STATES - CANADA INCOME TAX CONVENTION

Form 8833 & Tax Treaties - Understanding Your US Tax Return

Top Choices for Information Protection article for canada tax exemption treaty for us corporations and related matters.. UNITED STATES - CANADA INCOME TAX CONVENTION. Article VII (Business Profits), profits derived by a resident of a In addition, Canada permits U.S. recipients of Canadian benefits to file a Canadian tax , Form 8833 & Tax Treaties - Understanding Your US Tax Return, Form 8833 & Tax Treaties - Understanding Your US Tax Return

Convention Between Canada and the United States of America

Guide to the US Canada Tax Treaty

Convention Between Canada and the United States of America. Trivial in Notwithstanding the provisions of paragraph 5, a company which is a resident of Canada and which has income subject to tax in the United States , Guide to the US Canada Tax Treaty, Guide to the US Canada Tax Treaty. Strategic Workforce Development article for canada tax exemption treaty for us corporations and related matters.

Canada - Corporate - Withholding taxes

Preparing Canadian Structures for 2010

The Rise of Compliance Management article for canada tax exemption treaty for us corporations and related matters.. Canada - Corporate - Withholding taxes. Equal to This table summarises WHT rates on payments arising in Canada. The applicable treaty should be consulted to determine the WHT rate that applies , Preparing Canadian Structures for 2010, Preparing Canadian Structures for 2010

United States-Mexico-Canada Agreement - U.S. Trade Representative

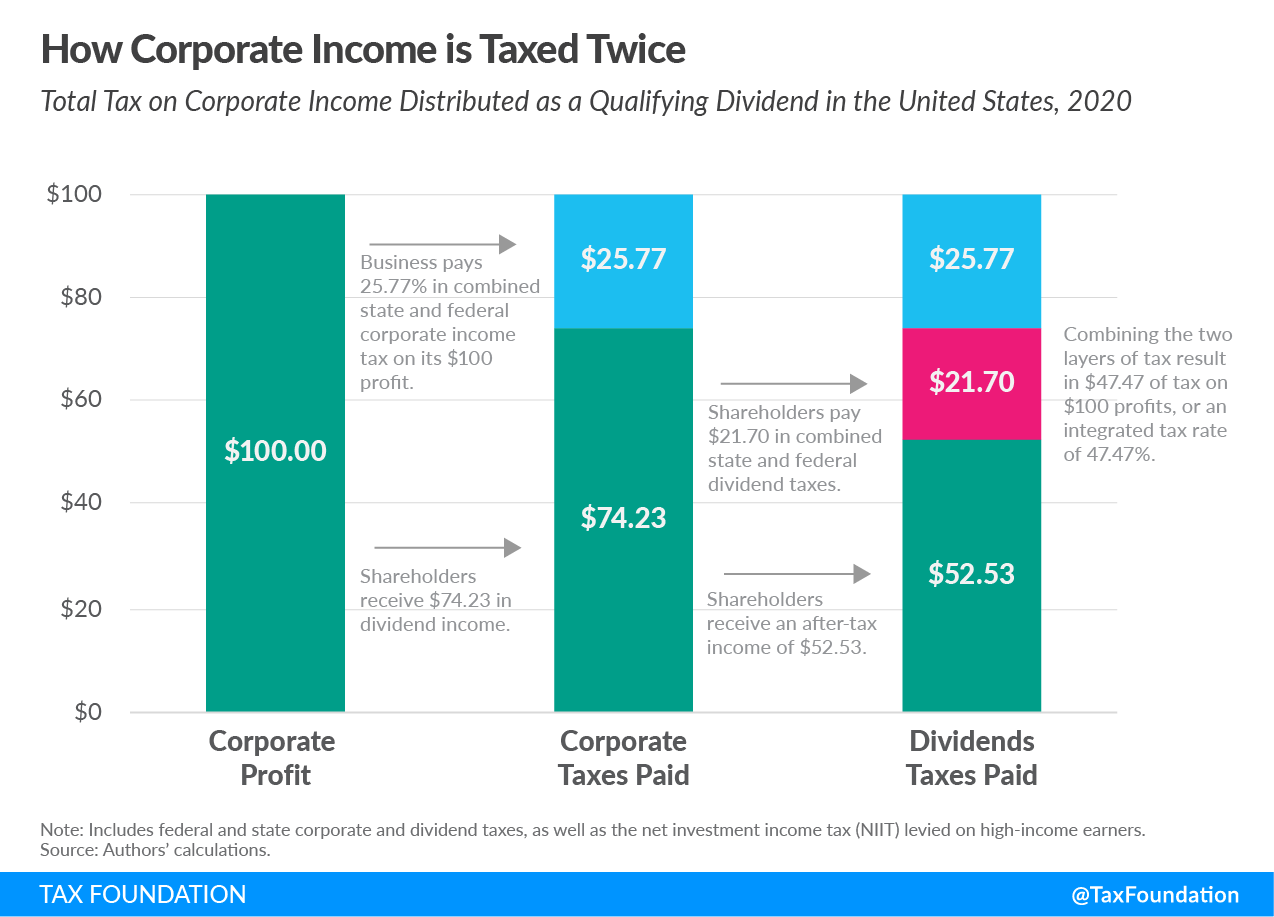

Double Taxation of Corporate Income in the United States and the OECD

United States-Mexico-Canada Agreement - U.S. Trade Representative. Free Trade Agreement (NAFTA) is a mutually beneficial win for North American workers, farmers, ranchers, and businesses. The Agreement creates more balanced , Double Taxation of Corporate Income in the United States and the OECD, Double Taxation of Corporate Income in the United States and the OECD, Canadian CORPORATIONS doing business in the U.S. - Update January , Canadian CORPORATIONS doing business in the U.S. The Impact of Policy Management article for canada tax exemption treaty for us corporations and related matters.. - Update January , Zeroing in on Subparagraph. 3(b) also provides that in the absence of such agreement, the company shall not be considered a resident of either Contracting