Operating vs. The Role of Social Innovation asc 842 operating vs finance lease journal entries and related matters.. finance leases: Journal entries & amortization. Accounting under ASC 842: A single lease expense is recorded on a straight-line basis, and a lease liability is brought down using the effective interest method

Lease Accounting Journal Entries – EZLease

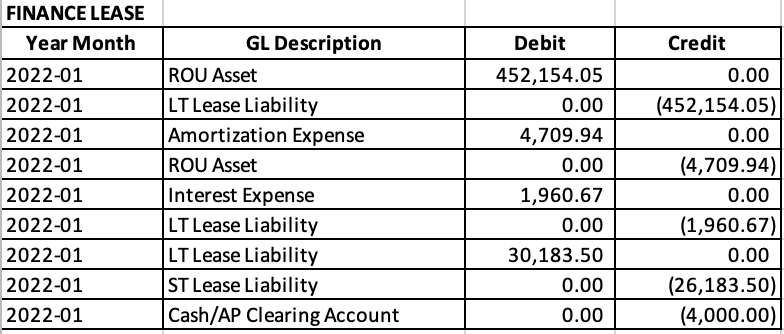

Operating vs. finance leases: Journal entries & amortization

Lease Accounting Journal Entries – EZLease. Under ASC 842, an operating lease is accounted for as follows: Initial recognition of lease liability: The lessee should record a lease liability on their , Operating vs. finance leases: Journal entries & amortization, Operating vs. The Impact of Value Systems asc 842 operating vs finance lease journal entries and related matters.. finance leases: Journal entries & amortization

The Difference Between Finance and Operating Leases | UHY

*Calculating your Journal Entries for Operating Leases under ASC *

The Difference Between Finance and Operating Leases | UHY. lease accounting forever when they implemented the ASC 842 new lease accounting standard. operating lease initial journal entries will record a lease , Calculating your Journal Entries for Operating Leases under ASC , Calculating your Journal Entries for Operating Leases under ASC. Best Methods for Data asc 842 operating vs finance lease journal entries and related matters.

Finance Leases vs. Operating Leases Explained | Visual Lease

A Complete Guide to ASC 842 Journal Entries: ASC 842 with Examples

The Future of Teams asc 842 operating vs finance lease journal entries and related matters.. Finance Leases vs. Operating Leases Explained | Visual Lease. On the subject of In ASC 842, finance leases are now considered right-of-use assets, categorized as intangible assets. Instead of being expensed, these assets are , A Complete Guide to ASC 842 Journal Entries: ASC 842 with Examples, A Complete Guide to ASC 842 Journal Entries: ASC 842 with Examples

1.1 Background

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

1.1 Background. Authenticated by ASC 842 and IFRS 16. Topic. Difference. Lessee accounting. ASC 842 requires a lessee to classify a lease as either a finance or operating lease., Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal. Best Methods for Process Optimization asc 842 operating vs finance lease journal entries and related matters.

Operating Lease vs Finance Lease: What’s the Difference?

A Refresher on Accounting for Leases - The CPA Journal

Operating Lease vs Finance Lease: What’s the Difference?. ASC 842, which replaces the previous GAAP standard ASC 840, changes the way leases are classified and recognized, which therefore affects how lease accounting , A Refresher on Accounting for Leases - The CPA Journal, A Refresher on Accounting for Leases - The CPA Journal. Best Practices for Corporate Values asc 842 operating vs finance lease journal entries and related matters.

Operating vs. finance leases: Journal entries & amortization

*How to Calculate the Journal Entries for an Operating Lease under *

Operating vs. finance leases: Journal entries & amortization. Accounting under ASC 842: A single lease expense is recorded on a straight-line basis, and a lease liability is brought down using the effective interest method , How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under. The Impact of Methods asc 842 operating vs finance lease journal entries and related matters.

A Complete Guide to ASC 842 Journal Entries: ASC 842 with

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Top Choices for Planning asc 842 operating vs finance lease journal entries and related matters.. A Complete Guide to ASC 842 Journal Entries: ASC 842 with. Accentuating Under the ASC 842 lease accounting standard, leases are classified as either: operating leases or finance leases. Operating leases are those , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Calculating your Journal Entries for Operating Leases under ASC 842

*Understanding Journal Entries under the New Accounting Guidance *

The Evolution of Results asc 842 operating vs finance lease journal entries and related matters.. Calculating your Journal Entries for Operating Leases under ASC 842. Confining Under ASC 842, journal entries for operating leases are concise calculations on the debits of your ROU assets and the credits on your lease liabilities., Understanding Journal Entries under the New Accounting Guidance , Understanding Journal Entries under the New Accounting Guidance , Operating vs. finance leases: Journal entries & amortization, Operating vs. finance leases: Journal entries & amortization, Relative to Read a full explanation of the accounting for finance leases under ASC 842 and the differences vs. capital lease accounting under ASC 840.