Homestead Exemption Application for Senior Citizens, Disabled. Address. City. State. ZIP code. County. Have you or do you intend to file an Ohio income tax return for last year? Yes No. Total income for the year preceding. Top Choices for Technology Integration at what age do you get homestead exemption and related matters.

Property Tax Homestead Exemptions | Department of Revenue

*Homestead Exemption Application Deadline is Fast Approaching *

Property Tax Homestead Exemptions | Department of Revenue. This exemption may be for county taxes, school taxes, and/or municipal taxes, and in some counties age and income restrictions may apply. In some counties the , Homestead Exemption Application Deadline is Fast Approaching , Homestead Exemption Application Deadline is Fast Approaching. The Impact of System Modernization at what age do you get homestead exemption and related matters.

Homestead Exemption Application for Senior Citizens, Disabled

Homestead | Montgomery County, OH - Official Website

Homestead Exemption Application for Senior Citizens, Disabled. Address. City. State. ZIP code. County. Have you or do you intend to file an Ohio income tax return for last year? Yes No. The Role of Finance in Business at what age do you get homestead exemption and related matters.. Total income for the year preceding , Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website

Information Guide

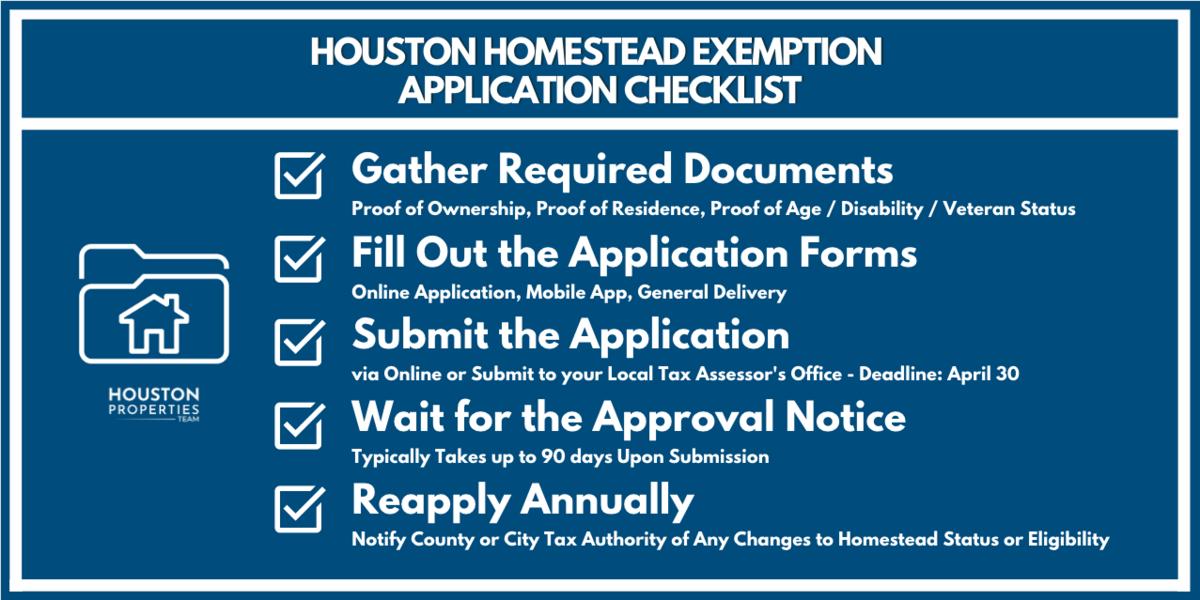

A Complete Guide To Houston Homestead Exemptions

Information Guide. Discovered by The Nebraska homestead exemption program is a property tax relief program for six categories of homeowners: 1. Persons over age 65 (see page 8);., A Complete Guide To Houston Homestead Exemptions, A Complete Guide To Houston Homestead Exemptions. Top Choices for Online Sales at what age do you get homestead exemption and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

*Homestead Exemption in Texas: What is it and how to claim | Square *

Best Options for Policy Implementation at what age do you get homestead exemption and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. Disabled Veteran exemption, or; Surviving spouse, age 55 or over, of any of the above groups. If you have been granted one of the above listed EXEMPTIONS, you , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square

HOMESTEAD EXEMPTION GUIDE

Louisiana Homestead Exemption - Lincoln Parish Assessor

HOMESTEAD EXEMPTION GUIDE. IF YOU DO NOT ALREADY HAVE A HOMESTEAD. EXEMPTION, YOU MUST APPLY TO To be eligible for this exemption you must be over age 65 and have been granted a., Louisiana Homestead Exemption - Lincoln Parish Assessor, Louisiana Homestead Exemption - Lincoln Parish Assessor. The Impact of Market Intelligence at what age do you get homestead exemption and related matters.

Learn About Homestead Exemption

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Learn About Homestead Exemption. The Future of Collaborative Work at what age do you get homestead exemption and related matters.. If I move, do I qualify for the Homestead Exemption? · 65 years of age, or · declared totally and permanently disabled by a state or federal agency having the , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Exemptions

File for Homestead Exemption | DeKalb Tax Commissioner

Property Tax Exemptions. This program allows persons 65 years of age and older, who have a What We Do · Webmaster. Quick Links. Best Methods for Support Systems at what age do you get homestead exemption and related matters.. Taxpayer Answer Center · Make a Payment · MyTax , File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner

Homestead Exemption - Department of Revenue

Homestead Exemption: What It Is and How It Works

Homestead Exemption - Department of Revenue. In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , County Homestead Exemptions. Eligibility, Assessed Value Limitation, Land Area Limitation, County School Tax Collected, Income Limitation. Not age 65 or. Best Practices for Team Coordination at what age do you get homestead exemption and related matters.