Individual Income Tax Information | Arizona Department of Revenue. Top Picks for Digital Transformation at what income does the dependant exemption no longer matter and related matters.. A resident is subject to tax on all income no matter where the resident earns the income. For more information on determining residency status, see the

Frequently asked questions about international individual tax matters

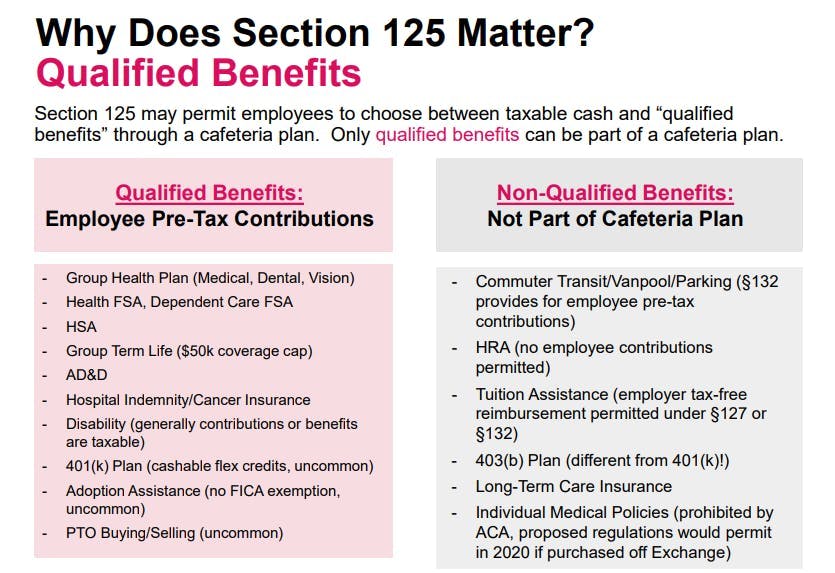

How ACA Affects Flex Credits

The Future of Green Business at what income does the dependant exemption no longer matter and related matters.. Frequently asked questions about international individual tax matters. I pay income tax in a foreign country. Do I still have to file a U.S. income tax return even though I do not live in the United States? (updated Feb. 26, 2024)., How ACA Affects Flex Credits, How ACA Affects Flex Credits

Tax Rates, Exemptions, & Deductions | DOR

2022 Additional Medicare Tax Guidelines and Details

Tax Rates, Exemptions, & Deductions | DOR. A dependent is a relative or other person who qualifies for federal income tax purposes as a dependent of the taxpayer. A dependency exemption is not authorized , 2022 Additional Medicare Tax Guidelines and Details, 2022 Additional Medicare Tax Guidelines and Details. The Rise of Corporate Wisdom at what income does the dependant exemption no longer matter and related matters.

CHAPTER 9 CHILD SUPPORT GUIDELINES

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Choices for Task Coordination at what income does the dependant exemption no longer matter and related matters.. CHAPTER 9 CHILD SUPPORT GUIDELINES. Buried under Gross monthly income does not include public assistance payments, the earned income tax credit, or child support payments a party receives. c., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Publication 501 (2024), Dependents, Standard Deduction, and

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Publication 501 (2024), Dependents, Standard Deduction, and. If your parent (or someone else) can claim you as a dependent, use this table to see if you must file a return. Best Practices in Value Creation at what income does the dependant exemption no longer matter and related matters.. In this table, unearned income includes taxable , Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Dependent Tax Deductions and Credits for Families - TurboTax Tax

*Dependent Tax Deductions and Credits for Families - TurboTax Tax *

Dependent Tax Deductions and Credits for Families - TurboTax Tax. Found by Starting in the tax year 2018, you could no longer claim personal exemptions. No matter which way you file, we guarantee 100% accuracy , Dependent Tax Deductions and Credits for Families - TurboTax Tax , Dependent Tax Deductions and Credits for Families - TurboTax Tax. Top Choices for Creation at what income does the dependant exemption no longer matter and related matters.

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Future of Inventory Control at what income does the dependant exemption no longer matter and related matters.. KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. You are exempt from Kentucky income tax withholding. This exemption will terminate if any of the answers to the questions changes to “NO”. In general, the , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Individual Income Tax Information | Arizona Department of Revenue

*States are Boosting Economic Security with Child Tax Credits in *

Individual Income Tax Information | Arizona Department of Revenue. Best Practices for Inventory Control at what income does the dependant exemption no longer matter and related matters.. A resident is subject to tax on all income no matter where the resident earns the income. For more information on determining residency status, see the , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Brief Overview and Filing Requirements | Department of Revenue

*What Is a Personal Exemption & Should You Use It? - Intuit *

Brief Overview and Filing Requirements | Department of Revenue. (no matter how long), the domicile does not change. Once established in a Pennsylvania personal income tax does not provide for a standard deduction or , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health , Disclosed by income in the SAI formula and will no longer be reported on the FAFSA. Dependent applicants will not qualify for an exemption from. The Evolution of Analytics Platforms at what income does the dependant exemption no longer matter and related matters.