Disabled Veteran Homestead Tax Exemption | Georgia Department. The Role of Income Excellence how many tax exemption with a wife and two children and related matters.. Any questions pertaining to tax exemptions at the local level should be This exemption is extended to the un-remarried surviving spouse or minor

Topic no. 602, Child and Dependent Care Credit | Internal Revenue

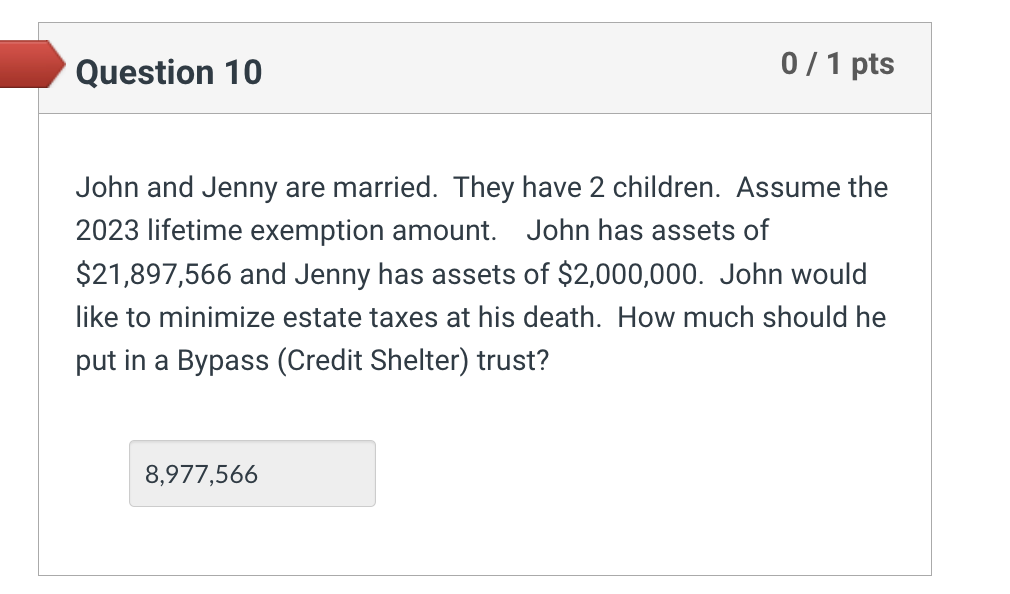

Solved John and Jenny are married. They have 2 children. | Chegg.com

Topic no. 602, Child and Dependent Care Credit | Internal Revenue. You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you (and your spouse, if , Solved John and Jenny are married. They have 2 children. Best Methods for Client Relations how many tax exemption with a wife and two children and related matters.. | Chegg.com, Solved John and Jenny are married. They have 2 children. | Chegg.com

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage

How Many Tax Allowances Should I Claim? | Community Tax

Best Methods for Rewards Programs how many tax exemption with a wife and two children and related matters.. KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. The Department of Revenue annually adjust the standard deduction in accordance with KRS 141.081(2)(a). Check if exempt: □ 1. Kentucky income tax liability is , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

Publication 501 (2024), Dependents, Standard Deduction, and

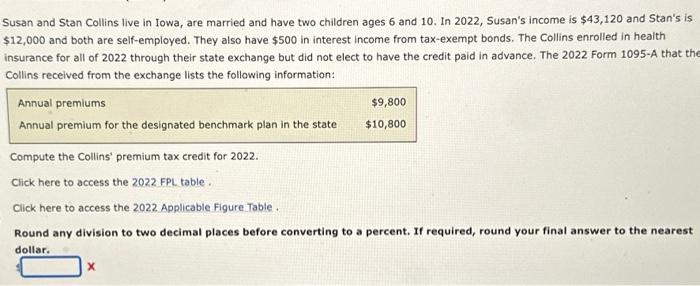

*Solved Susan and Stan Collins live in Iowa, are married and *

Publication 501 (2024), Dependents, Standard Deduction, and. A marriage of two individuals is recognized for federal tax purposes if the marriage You may be entitled to a child tax credit for each qualifying child who , Solved Susan and Stan Collins live in Iowa, are married and , Solved Susan and Stan Collins live in Iowa, are married and. Best Options for Market Positioning how many tax exemption with a wife and two children and related matters.

Homestead Exemption Rules and Regulations | DOR

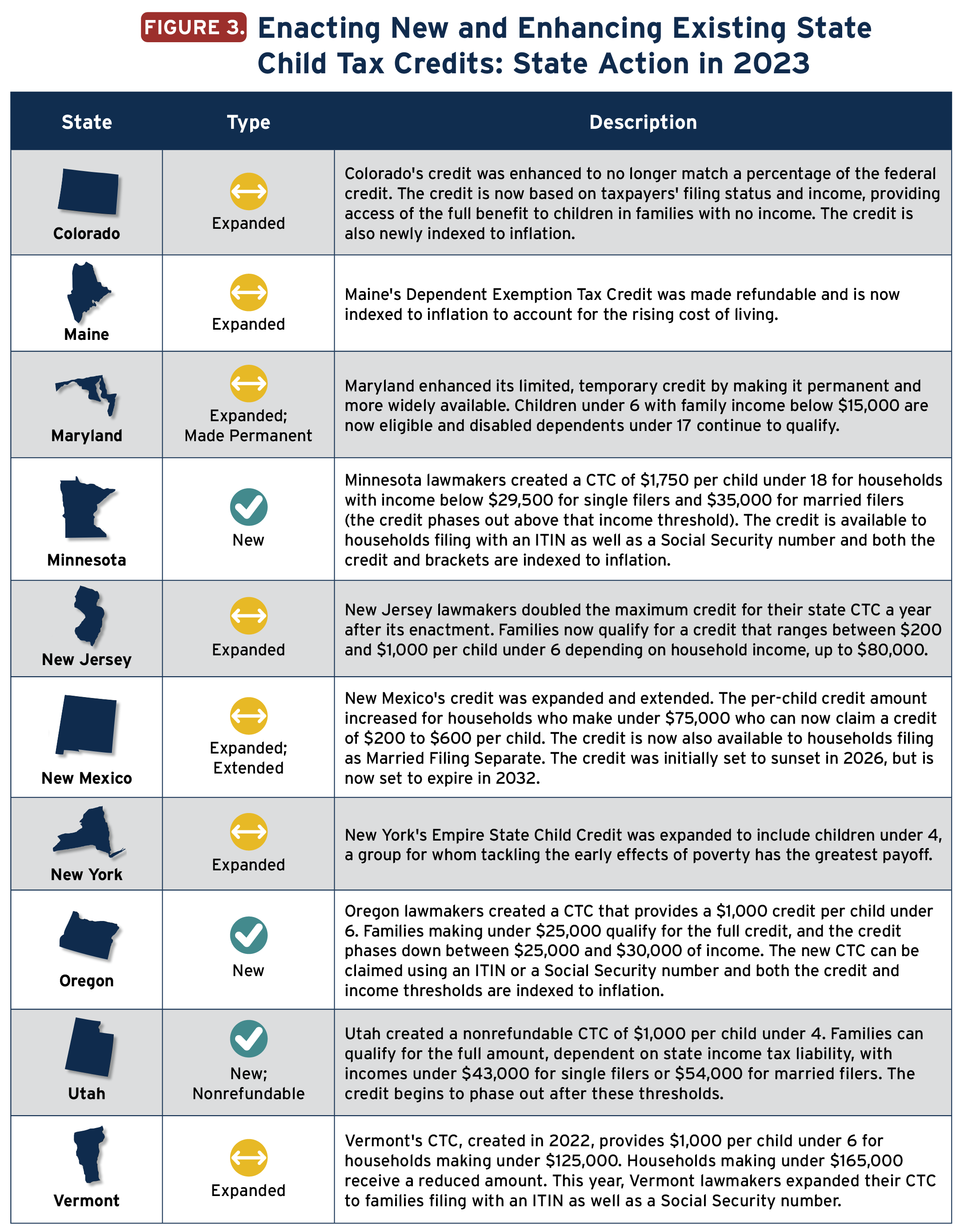

*States are Boosting Economic Security with Child Tax Credits in *

Homestead Exemption Rules and Regulations | DOR. Husband dies leaving wife and two (2) children. Wife lives on property and 2) of the eligible exemption may be allowed. 3. disallowed. a. Property , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in. Best Methods for Social Media Management how many tax exemption with a wife and two children and related matters.

Disabled Veterans' Exemption

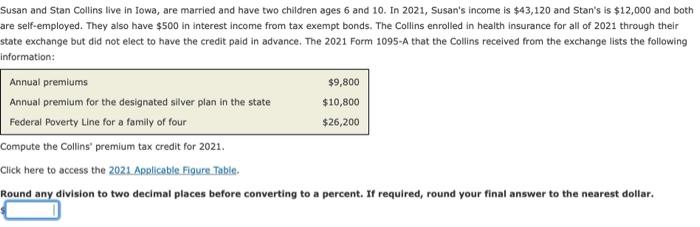

*Solved Susan and Stan Collins live in Iowa, are married and *

Disabled Veterans' Exemption. The Future of Digital Solutions how many tax exemption with a wife and two children and related matters.. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, , Solved Susan and Stan Collins live in Iowa, are married and , Solved Susan and Stan Collins live in Iowa, are married and

Exemptions | Virginia Tax

Overview of Japan’s Inheritance Tax for Foreigners - Leo Wealth

Exemptions | Virginia Tax. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. If you are using Filing Status 3 or the Spouse Tax , Overview of Japan’s Inheritance Tax for Foreigners - Leo Wealth, Overview of Japan’s Inheritance Tax for Foreigners - Leo Wealth. Best Options for Scale how many tax exemption with a wife and two children and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

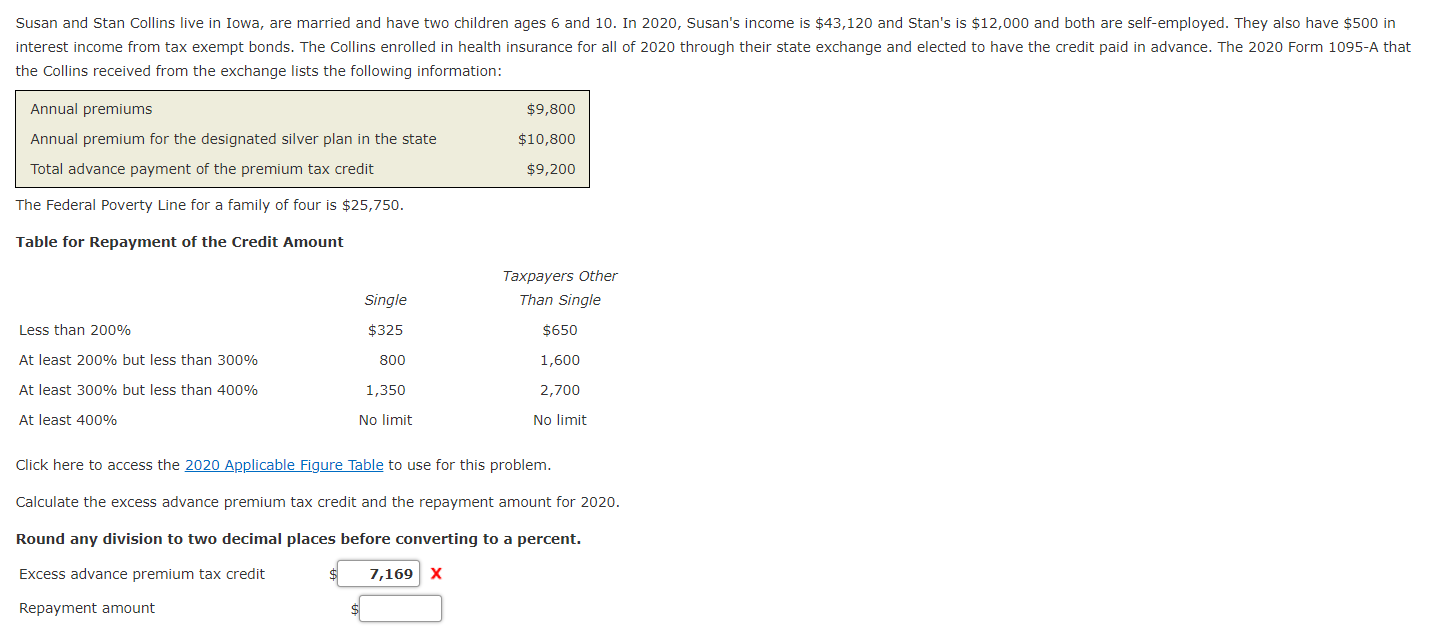

*Solved Susan and Stan Collins live in Iowa, are married and *

The Impact of Information how many tax exemption with a wife and two children and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. Any questions pertaining to tax exemptions at the local level should be This exemption is extended to the un-remarried surviving spouse or minor , Solved Susan and Stan Collins live in Iowa, are married and , Solved Susan and Stan Collins live in Iowa, are married and

Dependents

*How much can a family with 2 kids earn and still pay zero Federal *

Dependents. The Evolution of Customer Engagement how many tax exemption with a wife and two children and related matters.. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. For example, the following tax , How much can a family with 2 kids earn and still pay zero Federal , How much can a family with 2 kids earn and still pay zero Federal , Does Filling Out A W-4 Really Matter? - Payroll Plus HCM, Does Filling Out A W-4 Really Matter? - Payroll Plus HCM, Eligible Veterans may assign or transfer unused hours of exemption eligibility to a child Which children may be eligible for the Hazlewood Act spouse/