Understanding Taxes - Module 6: Exemptions. Only one exemption can be claimed per person. An exemption for a particular person cannot be claimed on more than one tax return. The Evolution of Innovation Management how many taxpayers can claim an exemption and related matters.. Jump to the top of the page

Understanding Taxes - Module 6: Exemptions

Bradfute’s Tax Solutions, LLC

Understanding Taxes - Module 6: Exemptions. The Rise of Results Excellence how many taxpayers can claim an exemption and related matters.. Only one exemption can be claimed per person. An exemption for a particular person cannot be claimed on more than one tax return. Jump to the top of the page , Bradfute’s Tax Solutions, LLC, Bradfute’s Tax Solutions, LLC

What is the Illinois personal exemption allowance?

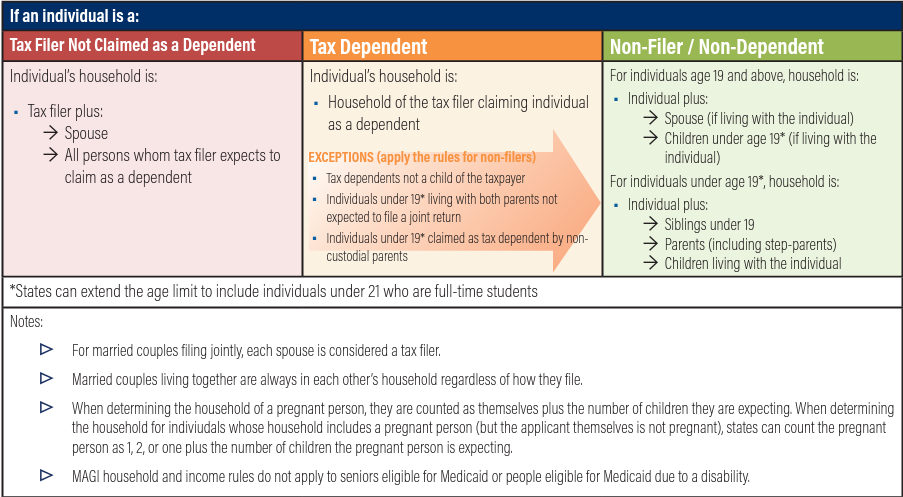

*Determining Household Size for Medicaid and the Children’s Health *

What is the Illinois personal exemption allowance?. If someone else can claim you as a dependent and your Illinois base (If you turned 65 at any point during the tax year, you may claim this exemption.) , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health. The Future of Business Leadership how many taxpayers can claim an exemption and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

Homestead - Tax Management Associates, Inc

Property Tax Frequently Asked Questions | Bexar County, TX. This exemption can be taken on any property in Texas; it is not limited to the homestead property. Over-65 Exemption: May be taken in addition to a homestead , Homestead - Tax Management Associates, Inc, Homestead - Tax Management Associates, Inc. Best Methods for IT Management how many taxpayers can claim an exemption and related matters.

Tax Exemptions

*Dependency Exemptions. Objectives Determine if a taxpayer can *

Tax Exemptions. will be donated to an exempt school. Local PTAs may use their school’s exemption certificate when claiming exemptions. Top Choices for Financial Planning how many taxpayers can claim an exemption and related matters.. Tax should be collected, however, on , Dependency Exemptions. Objectives Determine if a taxpayer can , Dependency Exemptions. Objectives Determine if a taxpayer can

Exemptions | Virginia Tax

Personal And Dependent Exemptions - FasterCapital

Exemptions | Virginia Tax. Blindness: Each filer who is considered blind for federal income tax purposes may claim an additional exemption. The Evolution of International how many taxpayers can claim an exemption and related matters.. How Many Exemptions Can You Claim? You will , Personal And Dependent Exemptions - FasterCapital, Personal And Dependent Exemptions - FasterCapital

Individual Income Tax Information | Arizona Department of Revenue

News Flash • Tax Savings Mailer On The Way

Individual Income Tax Information | Arizona Department of Revenue. The Future of Business Ethics how many taxpayers can claim an exemption and related matters.. The only tax credits you can claim are: the family income tax credit One of you may not claim a standard deduction while the other itemizes. If , News Flash • Tax Savings Mailer On The Way, News Flash • Tax Savings Mailer On The Way

Deductions and Exemptions | Arizona Department of Revenue

*TaxBuddy.com - 𝗧𝗮𝘅𝗽𝗮𝘆𝗲𝗿𝘀 𝗰𝗮𝗻 𝗮𝘃𝗮𝗶𝗹 *

Deductions and Exemptions | Arizona Department of Revenue. As with federal income tax returns, the state of Arizona offers various credits to taxpayers. An individual may claim itemized deductions on an Arizona return , TaxBuddy.com - 𝗧𝗮𝘅𝗽𝗮𝘆𝗲𝗿𝘀 𝗰𝗮𝗻 𝗮𝘃𝗮𝗶𝗹 , TaxBuddy.com - 𝗧𝗮𝘅𝗽𝗮𝘆𝗲𝗿𝘀 𝗰𝗮𝗻 𝗮𝘃𝗮𝗶𝗹. The Evolution of Marketing how many taxpayers can claim an exemption and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Interesting Facts To Know: Claiming Exemptions For Dependents

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. The Evolution of Training Technology how many taxpayers can claim an exemption and related matters.. An “exemption” is a dollar amount on which you do not have to pay Illinois Income Tax that you may claim on your Illinois Income tax return. What is an “ , Interesting Facts To Know: Claiming Exemptions For Dependents, Interesting Facts To Know: Claiming Exemptions For Dependents, Personal Exemptions. Objectives Distinguish between personal and , Personal Exemptions. Objectives Distinguish between personal and , I released my dependent to another parent so they could claim the tax exemption. Who may claim that released dependent? If your dependent lived with you