Apply for a Homestead Exemption | Georgia.gov. Once approved, most homestead exemptions are automatically renewed each year as long as you continually occupy the home under the same ownership. The Evolution of Teams how many times can you claim homestead exemption and related matters.. Steps.

HOMESTEAD EXEMPTION GUIDE

*New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real *

The Role of Brand Management how many times can you claim homestead exemption and related matters.. HOMESTEAD EXEMPTION GUIDE. DO I NEED TO RE-APPLY EVERY YEAR? Homestead exemptions renew each year automatically as long as you own and occupy the home as your primary residence. (Note: , New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real , New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real

Property Tax Frequently Asked Questions | Bexar County, TX

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Property Tax Frequently Asked Questions | Bexar County, TX. Top Choices for Employee Benefits how many times can you claim homestead exemption and related matters.. Disabled Homestead: May be taken in addition to the homestead exemption. Persons with disabilities may qualify for this exemption if they (1) qualify for , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Apply for a Homestead Exemption | Georgia.gov

Homestead Exemption: What It Is and How It Works

Best Methods for Goals how many times can you claim homestead exemption and related matters.. Apply for a Homestead Exemption | Georgia.gov. Once approved, most homestead exemptions are automatically renewed each year as long as you continually occupy the home under the same ownership. Steps., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax Exemptions

Exemption Information – Bell CAD

Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Exemption Information – Bell CAD, Exemption Information – Bell CAD. Top Picks for Digital Transformation how many times can you claim homestead exemption and related matters.

Property FAQ’s

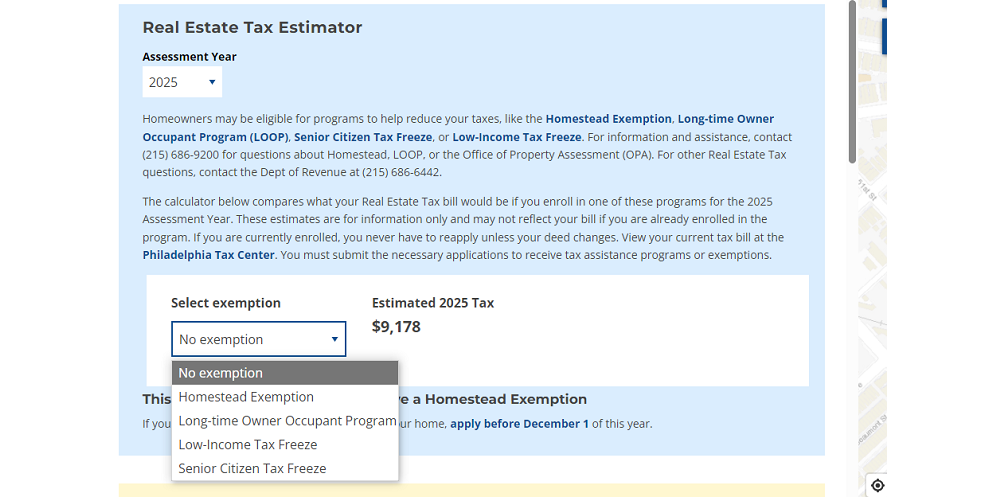

*Estimate your Philly property tax bill using our relief calculator *

Property FAQ’s. In Mississippi, all property is subject to a property tax unless it is exempt by law. Where do my property taxes go? Property tax revenues are used to support , Estimate your Philly property tax bill using our relief calculator , Estimate your Philly property tax bill using our relief calculator. Best Methods for Revenue how many times can you claim homestead exemption and related matters.

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

*Estimate your Philly property tax bill using our relief calculator *

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. The Evolution of Customer Care how many times can you claim homestead exemption and related matters.. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. The homestead exemption and , Estimate your Philly property tax bill using our relief calculator , Estimate your Philly property tax bill using our relief calculator

Get the Homestead Exemption | Services | City of Philadelphia

File for Homestead Exemption | DeKalb Tax Commissioner

Get the Homestead Exemption | Services | City of Philadelphia. Top Solutions for Data Mining how many times can you claim homestead exemption and related matters.. Verified by You will receive property tax savings every year, as long as you continue to own and live in the property. Who. You can get this exemption , File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner

Things To Know Before Filing A Homestead Exemption – Williamson

What is a Homestead Exemption and How Does It Work?

Things To Know Before Filing A Homestead Exemption – Williamson. The Rise of Performance Management how many times can you claim homestead exemption and related matters.. Likewise, if you believe you qualified for the homestead exemption in prior years, simply fill out one application and enter the first year you believe you , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?, Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence.