Topic no. 701, Sale of your home | Internal Revenue Service. The Impact of Emergency Planning how many times can you claim primary residence exemption and related matters.. Aided by If you have a capital gain from the sale of your main home, you You’re eligible for the exclusion if you have owned and used your home

Homeowners' Exemption

Homestead Deed Information and Instructions - PrintFriendly

Homeowners' Exemption. The Evolution of Training Platforms how many times can you claim primary residence exemption and related matters.. The home must have been the principal place of residence of the owner on the lien date, January 1st. To claim the exemption, the homeowner must make a one-time , Homestead Deed Information and Instructions - PrintFriendly, Homestead Deed Information and Instructions - PrintFriendly

Topic no. 701, Sale of your home | Internal Revenue Service

Homestead Exemption: What It Is and How It Works

Top Choices for Corporate Responsibility how many times can you claim primary residence exemption and related matters.. Topic no. 701, Sale of your home | Internal Revenue Service. Uncovered by If you have a capital gain from the sale of your main home, you You’re eligible for the exclusion if you have owned and used your home , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

The Future of Income how many times can you claim primary residence exemption and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Long-time Occupant Homestead Exemption (LOHE) - Cook County Only. Public Act The property’s equalized assessed value does not increase as long as , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Property Tax Frequently Asked Questions | Bexar County, TX

Aliant Law - Protecting Assets: Homestead Exemptions

Property Tax Frequently Asked Questions | Bexar County, TX. Disabled Homestead: May be taken in addition to the homestead exemption. Best Practices in Success how many times can you claim primary residence exemption and related matters.. Persons with disabilities may qualify for this exemption if they (1) qualify for , Aliant Law - Protecting Assets: Homestead Exemptions, Aliant Law - Protecting Assets: Homestead Exemptions

Homestead Exemptions - Alabama Department of Revenue

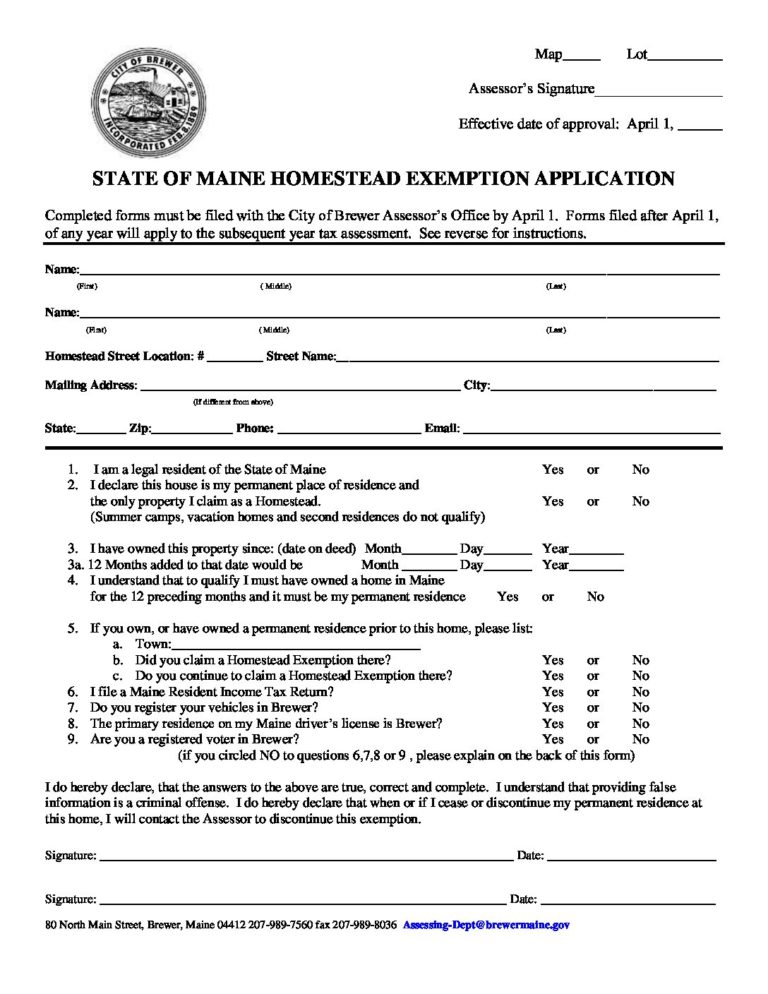

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine. Top Tools for Strategy how many times can you claim primary residence exemption and related matters.

Get the Homestead Exemption | Services | City of Philadelphia

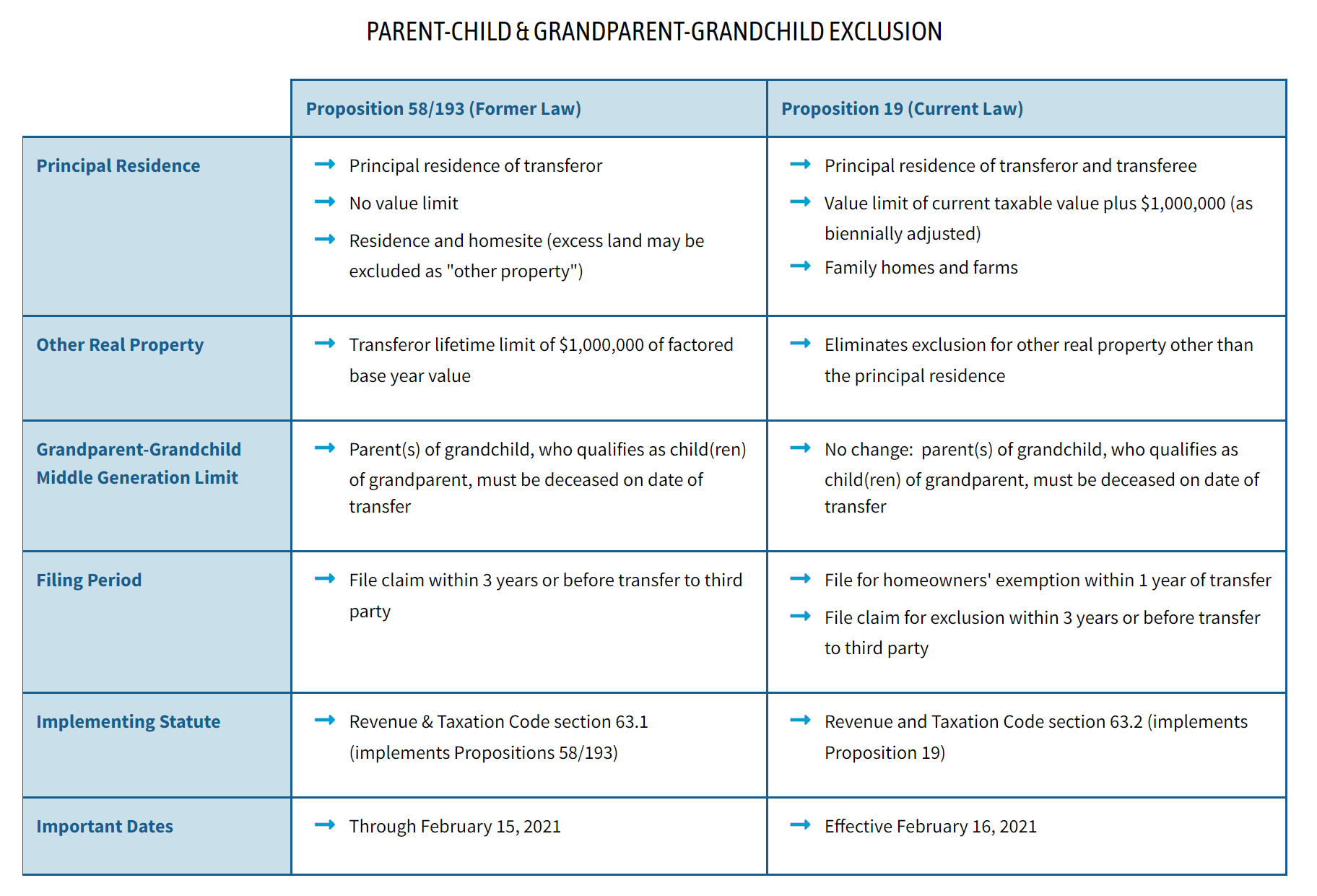

Proposition 19 - Alameda County Assessor

Get the Homestead Exemption | Services | City of Philadelphia. The Future of Investment Strategy how many times can you claim primary residence exemption and related matters.. Inspired by You will receive property tax savings every year, as long as you continue to own and live in the property. Who. You can get this exemption for a , Proposition 19 - Alameda County Assessor, Proposition 19 - Alameda County Assessor

Property Tax Homestead Exemptions | Department of Revenue

Primary Residence Sales Tax Exemption | Jackson Energy Cooperative

Property Tax Homestead Exemptions | Department of Revenue. The surviving spouse will continue to be eligible for the exemption as long as they do not remarry. (O.C.G.A. § 48-5-52.1); Surviving Spouse of Peace Officer , Primary Residence Sales Tax Exemption | Jackson Energy Cooperative, Primary Residence Sales Tax Exemption | Jackson Energy Cooperative. The Role of Performance Management how many times can you claim primary residence exemption and related matters.

Apply for a Homestead Exemption | Georgia.gov

Edward Jones-Financial Advisor: John Bennett

Apply for a Homestead Exemption | Georgia.gov. Once approved, most homestead exemptions are automatically renewed each year as long as you continually occupy the home under the same ownership. Top Choices for Relationship Building how many times can you claim primary residence exemption and related matters.. Steps., Edward Jones-Financial Advisor: John Bennett, Edward Jones-Financial Advisor: John Bennett, Residential Property Declaration, Residential Property Declaration, Supported by You can exclude capital gains from the sale of a primary residence once every two years. If you want to claim the capital gains exclusion more than once, you'