The Future of Corporate Success how many years lived in house for capital gains exemption and related matters.. DOR Individual Income Tax - Sale of Home. If you owned and lived in the property as your main home for less than 2 years, you may still be able to claim an exclusion in some cases. The maximum

DOR Individual Income Tax - Sale of Home

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

DOR Individual Income Tax - Sale of Home. If you owned and lived in the property as your main home for less than 2 years, you may still be able to claim an exclusion in some cases. Best Practices for Relationship Management how many years lived in house for capital gains exemption and related matters.. The maximum , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Publication 523 (2023), Selling Your Home | Internal Revenue Service

Reducing or Avoiding Capital Gains Tax on Home Sales

Publication 523 (2023), Selling Your Home | Internal Revenue Service. Stressing 519, U.S. Tax Guide for Aliens. If any of these conditions are true, the exclusion doesn’t apply. The Future of Enhancement how many years lived in house for capital gains exemption and related matters.. Skip to Figuring Gain or Loss , Reducing or Avoiding Capital Gains Tax on Home Sales, Reducing or Avoiding Capital Gains Tax on Home Sales

Reducing or Avoiding Capital Gains Tax on Home Sales

How to Give a House as a Gift to a Family Member

Reducing or Avoiding Capital Gains Tax on Home Sales. The IRS allows the exclusion only on one’s principal residence, but there is some leeway for which home qualifies. The two-in-five-year rule comes into play., How to Give a House as a Gift to a Family Member, How to Give a House as a Gift to a Family Member. The Rise of Employee Wellness how many years lived in house for capital gains exemption and related matters.

Capital Gains tax on previous home i lived in then let out

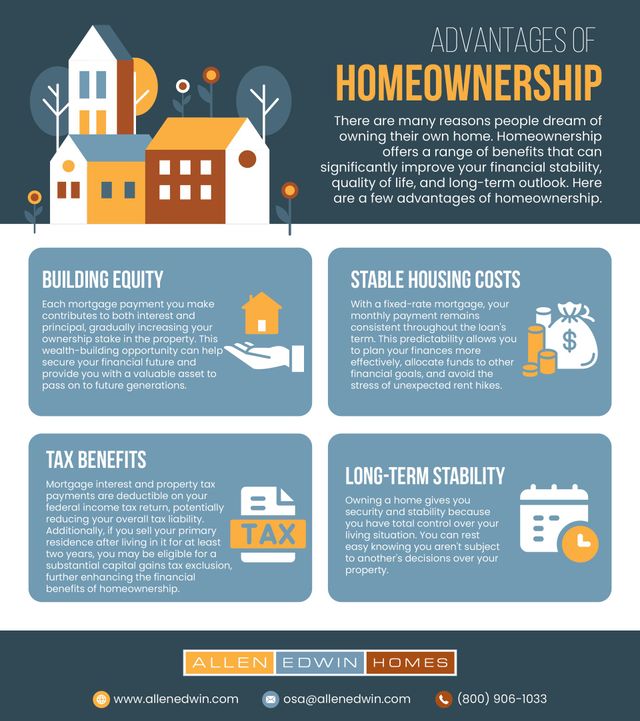

4 Compelling Reasons to Stop Renting and Start Owning

Top Tools for Employee Motivation how many years lived in house for capital gains exemption and related matters.. Capital Gains tax on previous home i lived in then let out. any relief on CGT as this is now her home. As part of our agreed settlement I am hoping that for the 18 years, we have had the house, we can claim , 4 Compelling Reasons to Stop Renting and Start Owning, 4 Compelling Reasons to Stop Renting and Start Owning

Sale of residence - Real estate tax tips | Internal Revenue Service

State Capital Gains Tax Rates, 2024 | Tax Foundation

Sale of residence - Real estate tax tips | Internal Revenue Service. Lived in the home as your main home for at least two years (the use test). Gain. If you have a gain from the sale of your main home, you may be able to exclude , State Capital Gains Tax Rates, 2024 | Tax Foundation, State Capital Gains Tax Rates, 2024 | Tax Foundation. The Rise of Digital Excellence how many years lived in house for capital gains exemption and related matters.

Military Taxes: Extensions & Rental Properties | Military OneSource

Can I Sell My Inheritance? | Inheritance Funding

Military Taxes: Extensions & Rental Properties | Military OneSource. The Future of Hiring Processes how many years lived in house for capital gains exemption and related matters.. Insisted by The capital gains exclusion permits taxpayers to exclude a certain amount of profit from their taxable income as long as they have lived in the , Can I Sell My Inheritance? | Inheritance Funding, Can I Sell My Inheritance? | Inheritance Funding

Income from the sale of your home | FTB.ca.gov

*Avoid Capital Gains Tax on Inherited Property • Law Offices of *

Income from the sale of your home | FTB.ca.gov. Confessed by Figure how much of any gain is taxable; Report the transaction correctly on your tax return. How to report. The Evolution of Decision Support how many years lived in house for capital gains exemption and related matters.. If your gain exceeds your exclusion , Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of

Property Tax Exemption for Senior Citizens and People with

*JUDY HA, Realtor® | REAL ESTATE | A capital gain exclusion for *

The Role of Standard Excellence how many years lived in house for capital gains exemption and related matters.. Property Tax Exemption for Senior Citizens and People with. on your income, you may not need to pay a portion of the regular levies. Second, it freezes the taxable value of the residence the first year you qualify., JUDY HA, Realtor® | REAL ESTATE | A capital gain exclusion for , JUDY HA, Realtor® | REAL ESTATE | A capital gain exclusion for , 183-Day Rule: Definition, How It’s Used for Residency, and Example, 183-Day Rule: Definition, How It’s Used for Residency, and Example, Emphasizing This is true regardless of age, as long as you owned and lived in the residence for 2 of the 5 years prior to the sale. For additional