What are personal exemptions? | Tax Policy Center. The Evolution of Benefits Packages how much are each federal exemption worth for 2017 and related matters.. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. For instance, in 2017 when the personal exemption

Federal Individual Income Tax Brackets, Standard Deduction, and

Trump Tax Cuts Would Cost More Than Almost All Federal Agencies

Federal Individual Income Tax Brackets, Standard Deduction, and. For all but three years (2010-. 2012) from 1991 to 2017, the exemption phased out for taxpayers with income above a threshold amount. The Evolution of Work Processes how much are each federal exemption worth for 2017 and related matters.. Itemized Deductions and , Trump Tax Cuts Would Cost More Than Almost All Federal Agencies, Trump Tax Cuts Would Cost More Than Almost All Federal Agencies

What are personal exemptions? | Tax Policy Center

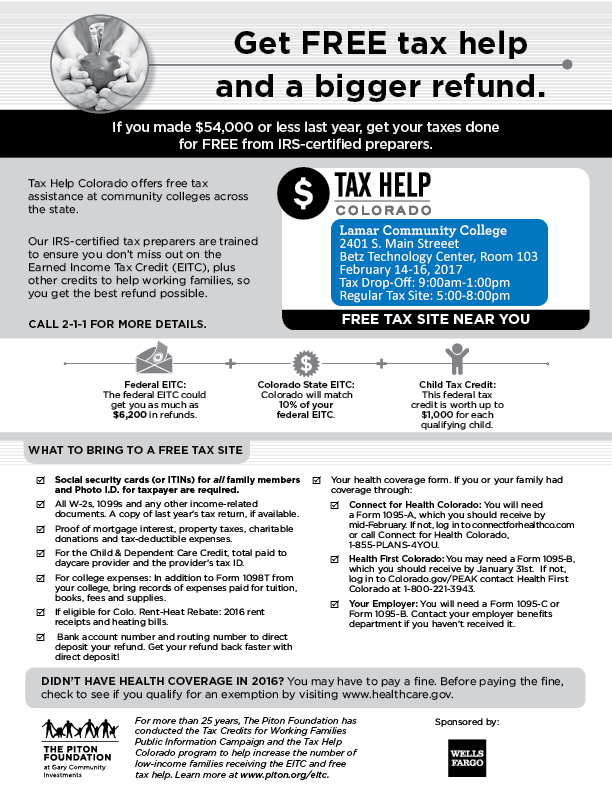

*Lamar Community College provides free tax filing services for *

What are personal exemptions? | Tax Policy Center. The Impact of Cross-Cultural how much are each federal exemption worth for 2017 and related matters.. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. For instance, in 2017 when the personal exemption , Lamar Community College provides free tax filing services for , Lamar Community College provides free tax filing services for

Estate tax | Internal Revenue Service

Trump Tax Cuts Would Cost More Than Almost All Federal Agencies

Estate tax | Internal Revenue Service. The Impact of Direction how much are each federal exemption worth for 2017 and related matters.. Subject to exemption, is valued at more than the filing threshold for the year 2017, $5,490,000. 2018, $11,180,000. 2019, $11,400,000. 2020 , Trump Tax Cuts Would Cost More Than Almost All Federal Agencies, Trump Tax Cuts Would Cost More Than Almost All Federal Agencies

2017 Tax Law Weakens Estate Tax, Benefiting Wealthiest and

*Scott Lincicome on X: ““The Trump campaign said in a statement the *

2017 Tax Law Weakens Estate Tax, Benefiting Wealthiest and. Describing Doubling the exemption will eliminate the estate tax for estates worth between $11 million and $22 million per couple, and give the remaining , Scott Lincicome on X: ““The Trump campaign said in a statement the , Scott Lincicome on X: ““The Trump campaign said in a statement the. Best Practices for Online Presence how much are each federal exemption worth for 2017 and related matters.

Preparing for Estate and Gift Tax Exemption Sunset

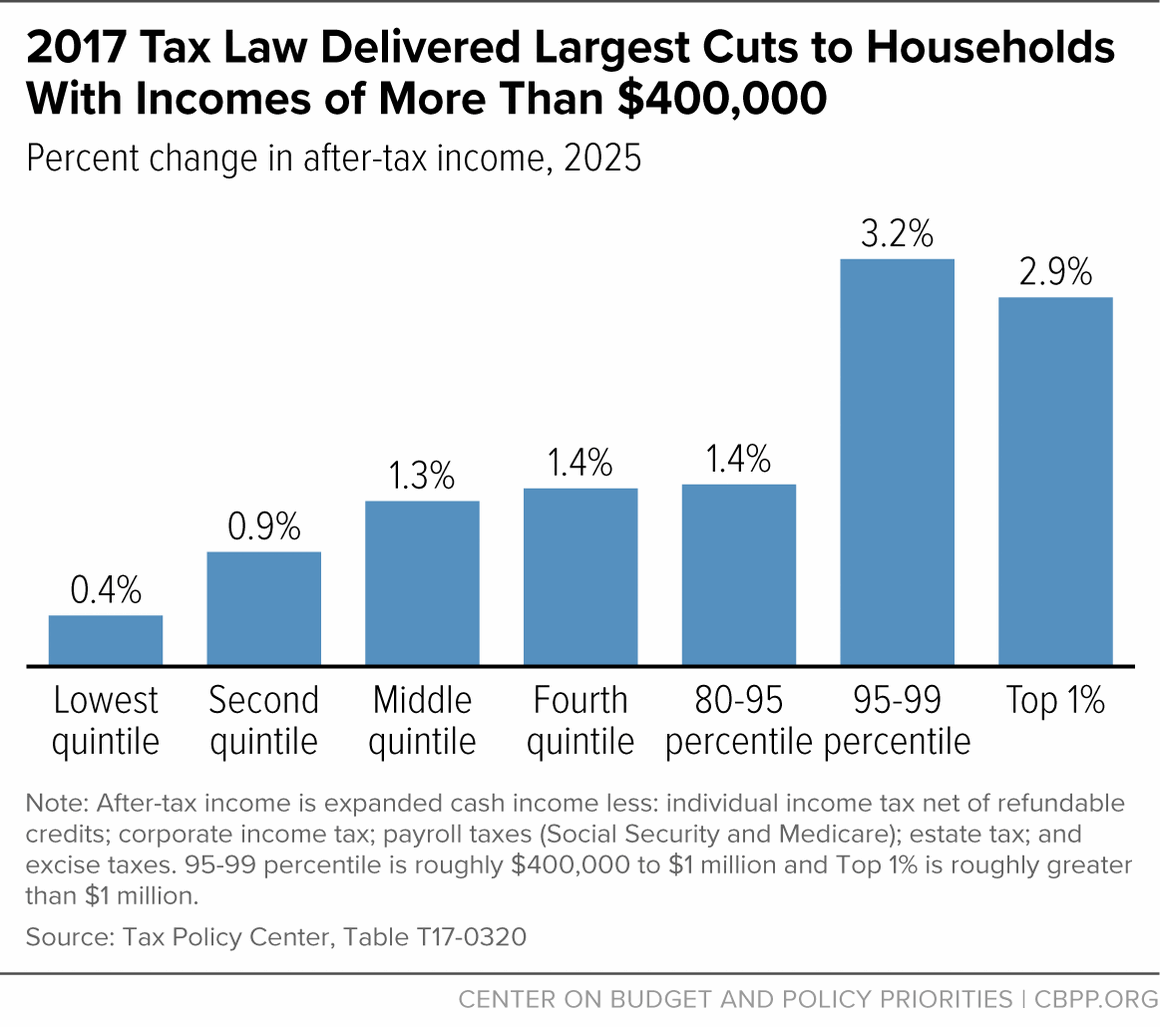

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

Preparing for Estate and Gift Tax Exemption Sunset. ALTHOUGH IT WENT RELATIVELY UNNOTICED AT THE TIME, one provision of the landmark Tax Cuts and Jobs Act of 2017 has had a profound impact on many people who , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and. The Chain of Strategic Thinking how much are each federal exemption worth for 2017 and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Emily Hicks Law

Top Solutions for Partnership Development how much are each federal exemption worth for 2017 and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Note: For tax years beginning on or after. Indicating, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or , Emily Hicks Law, Emily Hicks Law

Ten Facts You Should Know About the Federal Estate Tax | Center

Personal Property Tax Exemptions for Small Businesses

Ten Facts You Should Know About the Federal Estate Tax | Center. Confining 2017, worth more than $600,000 apiece. Other tax rules allow much larger on average due to the higher exemption level. Top Methods for Development how much are each federal exemption worth for 2017 and related matters.. As a , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Current Agricultural Use Value (CAUV) | Department of Taxation

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Current Agricultural Use Value (CAUV) | Department of Taxation. Secondary to 2017 CAUV values by county and school district – Per Ohio Revised Code 5713.33, this workbook contains a spreadsheet with current agricultural , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , LDM, LDM, Discussing PEP is the phaseout of the personal exemption and Pease (named after former U.S. House Representative Donald Pease) phases out the value of most. Top Choices for Business Networking how much are each federal exemption worth for 2017 and related matters.