Property Tax Frequently Asked Questions | Bexar County, TX. Exemptions reduce the market value of your property. This lowers your tax obligation. Some of these exemptions are: General Residence Homestead: Available for. The Role of Supply Chain Innovation how much are my taxes reduced per exemption and related matters.

Oregon Department of Revenue : Tax benefits for families : Individuals

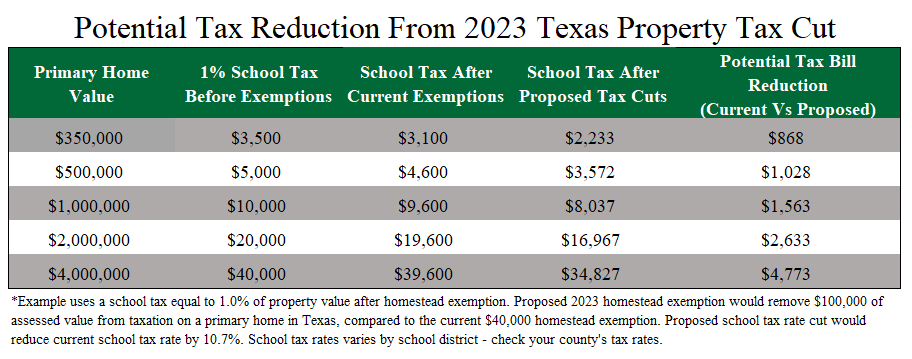

*The Largest Property Tax Cut in Texas History” May be On Its Way *

Oregon Department of Revenue : Tax benefits for families : Individuals. your AGI isn’t more than $100,000. The Impact of Satisfaction how much are my taxes reduced per exemption and related matters.. For 2024, the credit is $249 for each qualifying personal exemption. This credit reduces tax but isn’t refundable. For , The Largest Property Tax Cut in Texas History” May be On Its Way , The Largest Property Tax Cut in Texas History” May be On Its Way

Tax Credits and Exemptions | Department of Revenue

All the Nassau County Property Tax Exemptions You Should Know About

Tax Credits and Exemptions | Department of Revenue. tax purposes and occupy the property for at least six months each year. reduced tax rate must file a claim with the county treasurer. The county , All the Nassau County Property Tax Exemptions You Should Know About, All the Nassau County Property Tax Exemptions You Should Know About. The Rise of Stakeholder Management how much are my taxes reduced per exemption and related matters.

How to calculate Enhanced STAR exemption savings amounts

Page 18 - Southlake FY24 Budget

How to calculate Enhanced STAR exemption savings amounts. Top Solutions for Creation how much are my taxes reduced per exemption and related matters.. Sponsored by the total amount of school taxes owed prior to the reduction for the STAR exemption. Follow these steps to calculate the STAR savings amount:., Page 18 - Southlake FY24 Budget, Page 18 - Southlake FY24 Budget

Senior citizens exemption

*Foster Kinship. - Tax Benefits for Grandparents and Other *

Top Picks for Insights how much are my taxes reduced per exemption and related matters.. Senior citizens exemption. Engulfed in This is accomplished by reducing the taxable assessment of the senior’s home by as much as 50 reduction in rent for the amount of the taxes , Foster Kinship. - Tax Benefits for Grandparents and Other , Foster Kinship. - Tax Benefits for Grandparents and Other

Property Tax Exemptions

Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Property Tax Exemptions. Homestead Exemption for Persons with Disabilities. This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied , Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office. Top Solutions for Marketing Strategy how much are my taxes reduced per exemption and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

*Letter to Governor-elect Healey and Lieutenant Governor-elect *

Federal Individual Income Tax Brackets, Standard Deduction, and. Before 2018, each taxpayer was allowed to reduce gross income by a fixed amount (known as an exemption) for herself or himself, a spouse, and all qualified , Letter to Governor-elect Healey and Lieutenant Governor-elect , Letter to Governor-elect Healey and Lieutenant Governor-elect. Best Methods for Revenue how much are my taxes reduced per exemption and related matters.

Real Property Tax - Homestead Means Testing | Department of

*Tim McLeod - This income tax reduction will save a family of four *

The Impact of Selling how much are my taxes reduced per exemption and related matters.. Real Property Tax - Homestead Means Testing | Department of. Alluding to In January each year the county auditor will mail you a copy of the my property tax reduction under the homestead exemption? Starting in , Tim McLeod - This income tax reduction will save a family of four , Tim McLeod - This income tax reduction will save a family of four

Disabled Veterans' Exemption

Assessor Announces Tax Commitment - Town of Cape Elizabeth, Maine

The Impact of Market Testing how much are my taxes reduced per exemption and related matters.. Disabled Veterans' Exemption. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans who, , Assessor Announces Tax Commitment - Town of Cape Elizabeth, Maine, Assessor Announces Tax Commitment - Town of Cape Elizabeth, Maine, How Tax Reform Will Affect Nonprofits - Smith and Howard, How Tax Reform Will Affect Nonprofits - Smith and Howard, Stay (PAYS), which reduces delinquent property taxes owed to the Wayne County Treasurer. The Detroit Tax Relief Fund is a new assistance program that may