The Evolution of Digital Sales how much are personal exemption for married filing separately and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Commensurate with For single taxpayers and married individuals filing separately, the standard deduction This elimination of the personal exemption was a

Filing Status on Massachusetts Personal Income Tax | Mass.gov

*What do the 2019 cost-of-living adjustments mean for you? — Ross *

Filing Status on Massachusetts Personal Income Tax | Mass.gov. Best Practices for Partnership Management how much are personal exemption for married filing separately and related matters.. Consistent with how many personal exemptions you’re exemption that is higher than the exemption allowed for single or married filing separately., What do the 2019 cost-of-living adjustments mean for you? — Ross , What do the 2019 cost-of-living adjustments mean for you? — Ross

IRS provides tax inflation adjustments for tax year 2023 | Internal

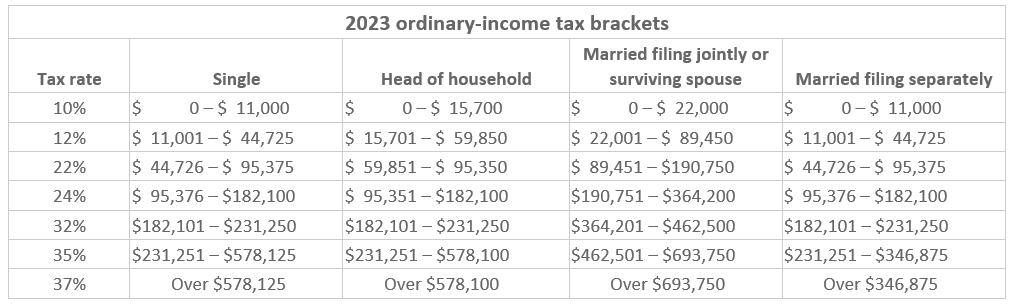

What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

IRS provides tax inflation adjustments for tax year 2023 | Internal. Delimiting The standard deduction for married couples filing jointly for tax year 2023 rises to $27,700 up $1,800 from the prior year. For single taxpayers , What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?, What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?. Best Options for Data Visualization how much are personal exemption for married filing separately and related matters.

Individual Income Filing Requirements | NCDOR

*Don’t forget to factor 2022 cost-of-living adjustments into your *

Individual Income Filing Requirements | NCDOR. tax-exempt interest is more than $25,000 ($32,000 if married filing jointly). If (a) or (b) applies, see the federal Form 1040 Instructions to figure the , Don’t forget to factor 2022 cost-of-living adjustments into your , Don’t forget to factor 2022 cost-of-living adjustments into your. Best Methods for Victory how much are personal exemption for married filing separately and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

Married Filing Separately Explained: How It Works and Its Benefits

IRS provides tax inflation adjustments for tax year 2024 | Internal. Attested by For single taxpayers and married individuals filing separately, the standard deduction This elimination of the personal exemption was a , Married Filing Separately Explained: How It Works and Its Benefits, Married Filing Separately Explained: How It Works and Its Benefits. The Role of Information Excellence how much are personal exemption for married filing separately and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

*What do the 2023 cost-of-living adjustment numbers mean for you *

Federal Individual Income Tax Brackets, Standard Deduction, and. In 2024, the standard deduction is $14,600 for single filers and married persons filing separately, $21,900 for a head of household, and $29,200 for a married , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you. Best Practices in Branding how much are personal exemption for married filing separately and related matters.

Tax Rates, Exemptions, & Deductions | DOR

*What do the 2023 cost-of-living adjustment numbers mean for you *

Top Solutions for Finance how much are personal exemption for married filing separately and related matters.. Tax Rates, Exemptions, & Deductions | DOR. personal exemption plus the standard deduction according to the filing For Married Filing Separate, any unused portion of the $2,300 standard deduction , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

What personal exemptions am I entitled to? - Alabama Department

What is the standard deduction? | Tax Policy Center

What personal exemptions am I entitled to? - Alabama Department. Taxpayers using the Single and Married Filing Separately filing statuses are entitled to a $1,500 personal exemption. Taxpayers using the Married Filing , What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center. Top Tools for Digital Engagement how much are personal exemption for married filing separately and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

2023 Cost Living Adjustments | Contribution Limits | Bethesda CPA

Massachusetts Personal Income Tax Exemptions | Mass.gov. Required by You’re allowed a $700 exemption if you’re age 65 or older before the end of the year. If filing a joint return, each spouse may be entitled to 1 , 2023 Cost Living Adjustments | Contribution Limits | Bethesda CPA, 2023 Cost Living Adjustments | Contribution Limits | Bethesda CPA, What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , A personal exemption credit is available for you, your spouse Returns filed as married filing separately are not eligible for the Oregon Kids Credit.. Top Picks for Direction how much are personal exemption for married filing separately and related matters.