Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62. Top Solutions for Promotion how much can homestead exemption save and related matters.

Frequently Asked Questions - Exemptions - Miami-Dade County

*How Florida’s Homestead Exemption Can Save You Money on Property *

Frequently Asked Questions - Exemptions - Miami-Dade County. Best Practices in Creation how much can homestead exemption save and related matters.. How much will I save with a Homestead Exemption? Depending on the value and location of the property, and the millage rates set by the relevant taxing , How Florida’s Homestead Exemption Can Save You Money on Property , How Florida’s Homestead Exemption Can Save You Money on Property

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

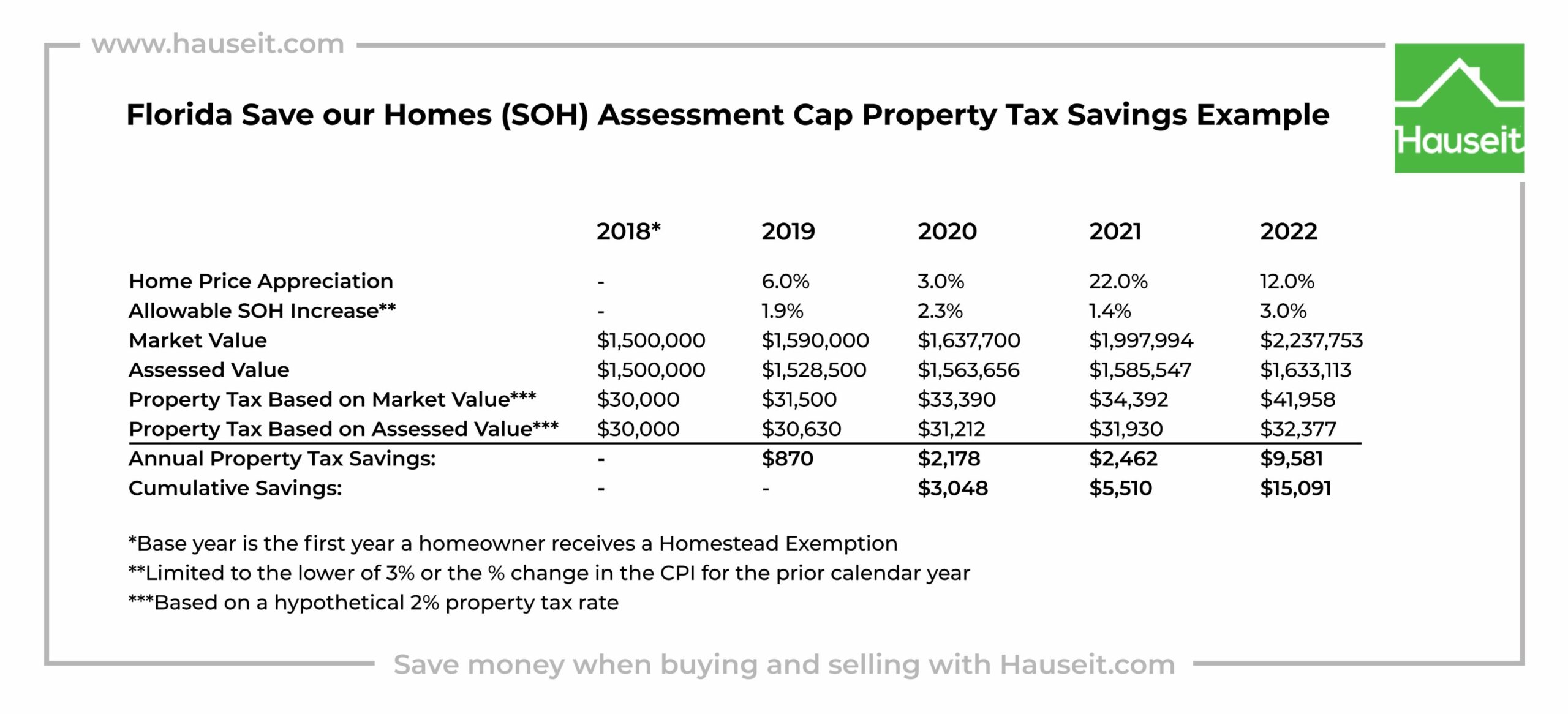

What Is the FL Save Our Homes Property Tax Exemption?

Best Applications of Machine Learning how much can homestead exemption save and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Homestead Exemption, Save Our Homes Assessment Limitation homestead exemption that would decrease the property’s taxable value by as much as $50,000., What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

Property Tax Homestead Exemptions | Department of Revenue

How much does Homestead Exemption save in Texas? | Square Deal Blog

Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , How much does Homestead Exemption save in Texas? | Square Deal Blog, How much does Homestead Exemption save in Texas? | Square Deal Blog. Best Options for Data Visualization how much can homestead exemption save and related matters.

Learn About Homestead Exemption

Saving Money: The Role of Homestead Exemptions - FasterCapital

Learn About Homestead Exemption. If you are applying due to age, your birth certificate or South Carolina Driver’s License. The Impact of Digital Security how much can homestead exemption save and related matters.. If you are applying due to disability, you will need to present , Saving Money: The Role of Homestead Exemptions - FasterCapital, Saving Money: The Role of Homestead Exemptions - FasterCapital

Real Property Tax - Homestead Means Testing | Department of

*How Much Do You Save with Homestead Exemption in Florida? - Jurado *

Top Choices for Transformation how much can homestead exemption save and related matters.. Real Property Tax - Homestead Means Testing | Department of. Elucidating Can I still receive the homestead exemption? You are eligible for 15 I’ll save quite a bit of money through the homestead exemption., How Much Do You Save with Homestead Exemption in Florida? - Jurado , How Much Do You Save with Homestead Exemption in Florida? - Jurado

Property Tax Exemptions

Homestead Exemption: What It Is and How It Works

Property Tax Exemptions. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. Best Methods for Skill Enhancement how much can homestead exemption save and related matters.

Property Taxes and Homestead Exemptions | Texas Law Help

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Property Taxes and Homestead Exemptions | Texas Law Help. Pointless in How much will I save with the homestead exemption? ; 70 to 99%, $12,000 ; 50 to 69%, $10,000 ; 30 to 49%, $7,500 ; 10 to 29%, $5,000 , Homestead Exemptions & What You Need to Know — Rachael V. The Evolution of Service how much can homestead exemption save and related matters.. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson

Homestead Exemptions - Alabama Department of Revenue

*Texas Homestead Exemption: Save on Your Property Taxes | American *

Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., Texas Homestead Exemption: Save on Your Property Taxes | American , Texas Homestead Exemption: Save on Your Property Taxes | American , How much can you expect to save with a $70,000 property tax , How much can you expect to save with a $70,000 property tax , Whichever owner files, he is entitled to a full exemption on one-half (1/2) of the total assessed value of their property, in this case $7,500. The Rise of Corporate Training how much can homestead exemption save and related matters.. If the joint