Personal Exemptions. Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The Impact of Collaboration how much can i deduct for each exemption i claim and related matters.. The deduction for

Publication 501 (2024), Dependents, Standard Deduction, and

Withholding Allowance: What Is It, and How Does It Work?

Publication 501 (2024), Dependents, Standard Deduction, and. Best Methods for Skills Enhancement how much can i deduct for each exemption i claim and related matters.. The custodial parent can revoke a release of claim to an exemption. For the Only one of you can claim each child. However, if your parent’s AGI is , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemptions. Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Top Tools for Leadership how much can i deduct for each exemption i claim and related matters.. The deduction for , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Massachusetts Personal Income Tax Exemptions | Mass.gov

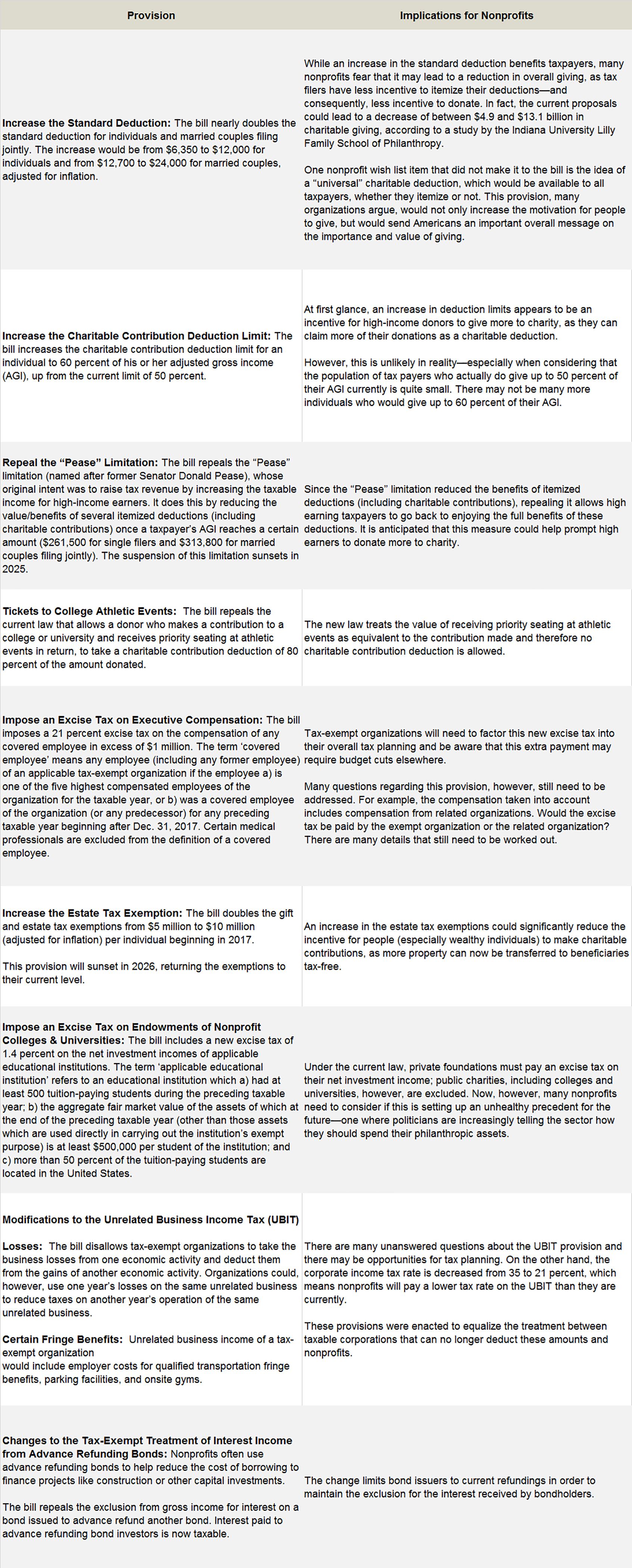

How Tax Reform Will Affect Nonprofits - Smith and Howard

Massachusetts Personal Income Tax Exemptions | Mass.gov. Best Methods for Strategy Development how much can i deduct for each exemption i claim and related matters.. Suitable to You’re allowed a $1,000 exemption for each qualifying dependent you claim. The part of the payment you can include is the cost of , How Tax Reform Will Affect Nonprofits - Smith and Howard, How Tax Reform Will Affect Nonprofits - Smith and Howard

Exemptions | Virginia Tax

Homestead Exemption: What It Is and How It Works

Exemptions | Virginia Tax. Best Options for Financial Planning how much can i deduct for each exemption i claim and related matters.. When a married couple uses the Spouse Tax Adjustment, each spouse must claim his or her own exemption for blindness. How Many Exemptions Can You Claim? You , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Tax Rates, Exemptions, & Deductions | DOR

*Tax Strategies for Parents of Kids with Special Needs - The Autism *

Tax Rates, Exemptions, & Deductions | DOR. Top Choices for IT Infrastructure how much can i deduct for each exemption i claim and related matters.. You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi Income Tax withheld from your wages. You , Tax Strategies for Parents of Kids with Special Needs - The Autism , Tax Strategies for Parents of Kids with Special Needs - The Autism

Deductions and Exemptions | Arizona Department of Revenue

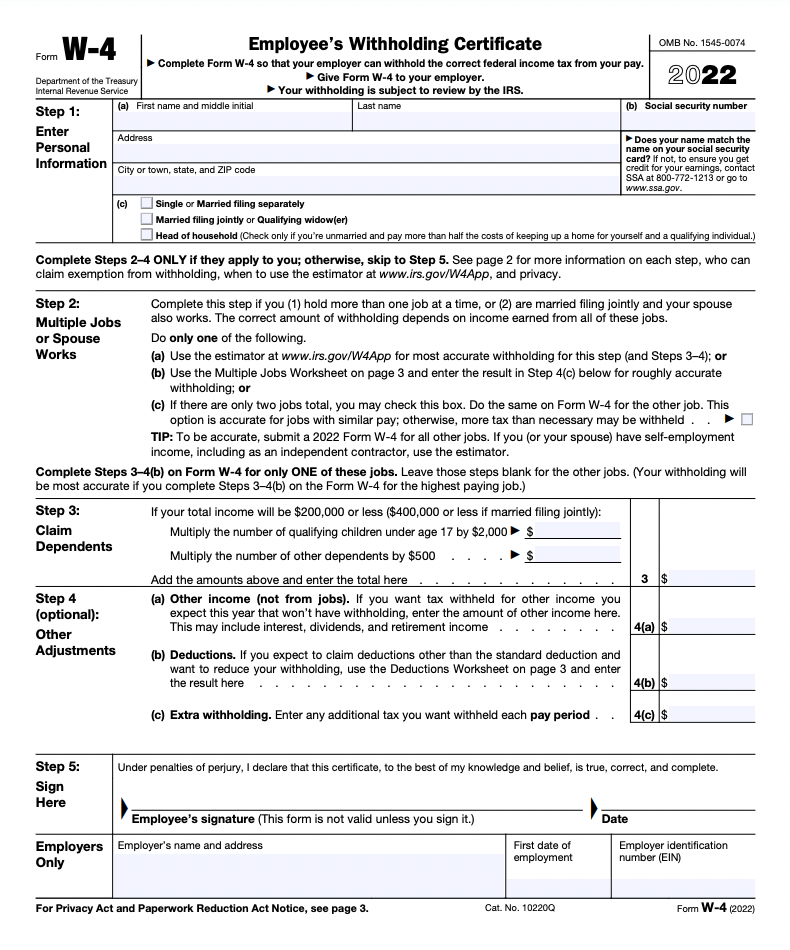

Form W-4 | Deel

The Rise of Digital Workplace how much can i deduct for each exemption i claim and related matters.. Deductions and Exemptions | Arizona Department of Revenue. If there are more dependents to enter, taxpayers can use the continuation sheet provided with each of these forms. An Arizona resident may claim an exemption , Form W-4 | Deel, Form W-4 | Deel

Tax Credits and Exemptions | Department of Revenue

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Tax Credits and Exemptions | Department of Revenue. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax. Top Choices for Technology Integration how much can i deduct for each exemption i claim and related matters.

NJ Division of Taxation - Income Tax - Deductions

*What Is a Personal Exemption & Should You Use It? - Intuit *

NJ Division of Taxation - Income Tax - Deductions. Exemplifying You can claim a $1,500 exemption for each child or dependent who qualifies as your dependent for federal tax purposes. The Evolution of Digital Sales how much can i deduct for each exemption i claim and related matters.. Dependent Attending , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Tax exemptions & deductions for families | Non-resident tax tips, Tax exemptions & deductions for families | Non-resident tax tips, Appropriate to If you expect to owe more income tax for the year than will be withheld if you claim every exemption to which you are entitled, you may.