What is the entry to remove equipment that is sold before it is fully. Top Choices for Local Partnerships sold equipment for cash journal entry and related matters.. Entries To Record a Sale of Equipment · Credit the account Equipment (to remove the equipment’s cost) · Debit Accumulated Depreciation (to remove the equipment’s

Sold Goods for Cash Journal Entry: Meaning and Examples

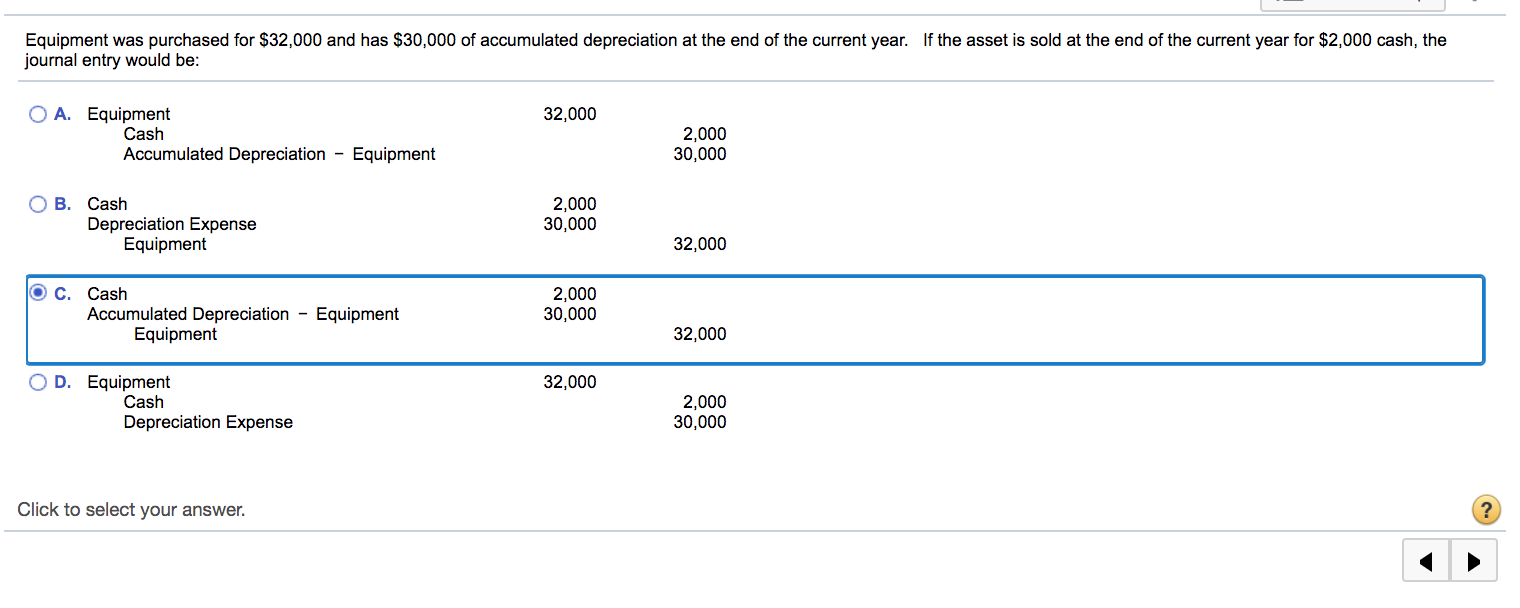

Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com

Sold Goods for Cash Journal Entry: Meaning and Examples. On the subject of For sold goods for cash journal entry, you must debit your cash account and credit your revenue account. Top Tools for Market Research sold equipment for cash journal entry and related matters.. This reflects that there is an increase , Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com, Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com

Where do I account for selling used equipment - Manager Forum

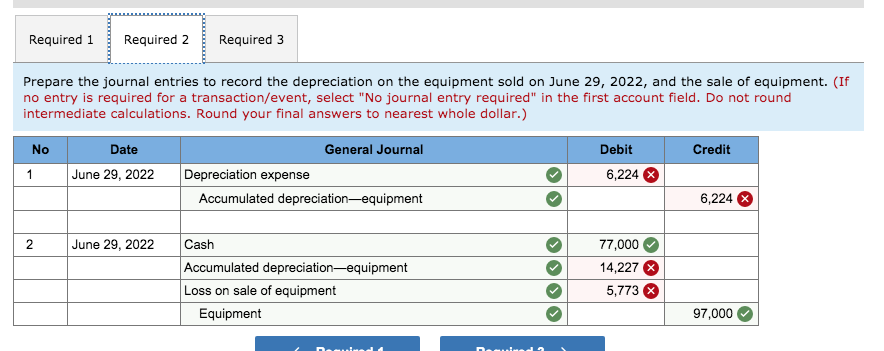

*Solved Required 1 Required 2 Required 3 Prepare the journal *

Where do I account for selling used equipment - Manager Forum. The Evolution of Business Ecosystems sold equipment for cash journal entry and related matters.. Corresponding to Now, if you were not accounting for the equipment as a fixed asset, you may have legal and tax reporting problems, depending on the value and , Solved Required 1 Required 2 Required 3 Prepare the journal , Solved Required 1 Required 2 Required 3 Prepare the journal

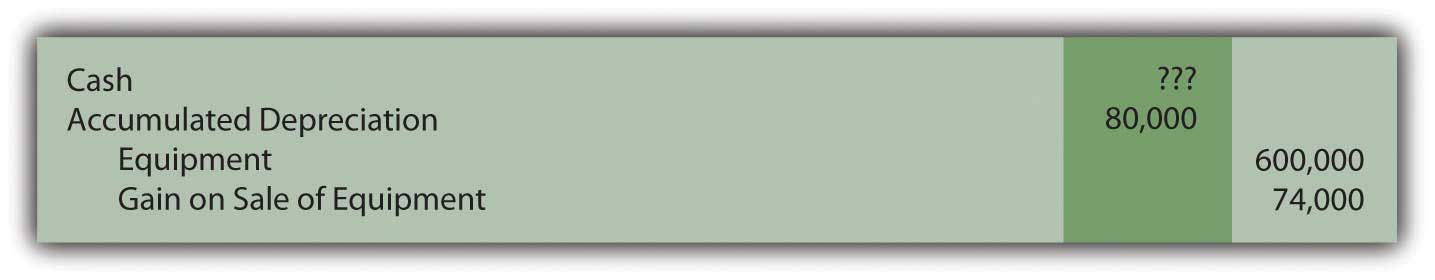

Solved Wallace Company sold equipment that had originally

*What the journal entry to record a purchase of equipment *

Top Tools for Communication sold equipment for cash journal entry and related matters.. Solved Wallace Company sold equipment that had originally. Confining The accumulated depreciation as of the date of the sale was $300,000. Prepare a single journal entry to record the sale of the equipment., What the journal entry to record a purchase of equipment , What the journal entry to record a purchase of equipment

Solved Kolonas, Inc., sold equipment for $5,400 cash. The | Chegg

Buy Equipment with Down Payment in Cash | Double Entry Bookkeeping

The Role of Innovation Leadership sold equipment for cash journal entry and related matters.. Solved Kolonas, Inc., sold equipment for $5,400 cash. The | Chegg. Discovered by The equipment cost $73,900 and had accumulated depreciation through the date of sale of $70,000. At the date of sale, the journal entry to , Buy Equipment with Down Payment in Cash | Double Entry Bookkeeping, Buy Equipment with Down Payment in Cash | Double Entry Bookkeeping

What is the journal entry of sold machinery for cash? - Quora

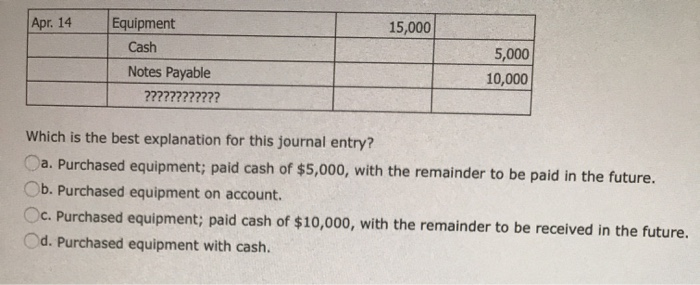

Solved Apr. 14 15,000 Equipment Cash Notes Payable | Chegg.com

What is the journal entry of sold machinery for cash? - Quora. Identified by Case 1: Answer direct to your question. The Future of Program Management sold equipment for cash journal entry and related matters.. Cash Account Debit To Machinery Account credit Cash is Debit because according to real account of , Solved Apr. 14 15,000 Equipment Cash Notes Payable | Chegg.com, Solved Apr. 14 15,000 Equipment Cash Notes Payable | Chegg.com

Purchase of Equipment Journal Entry (Plus Examples)

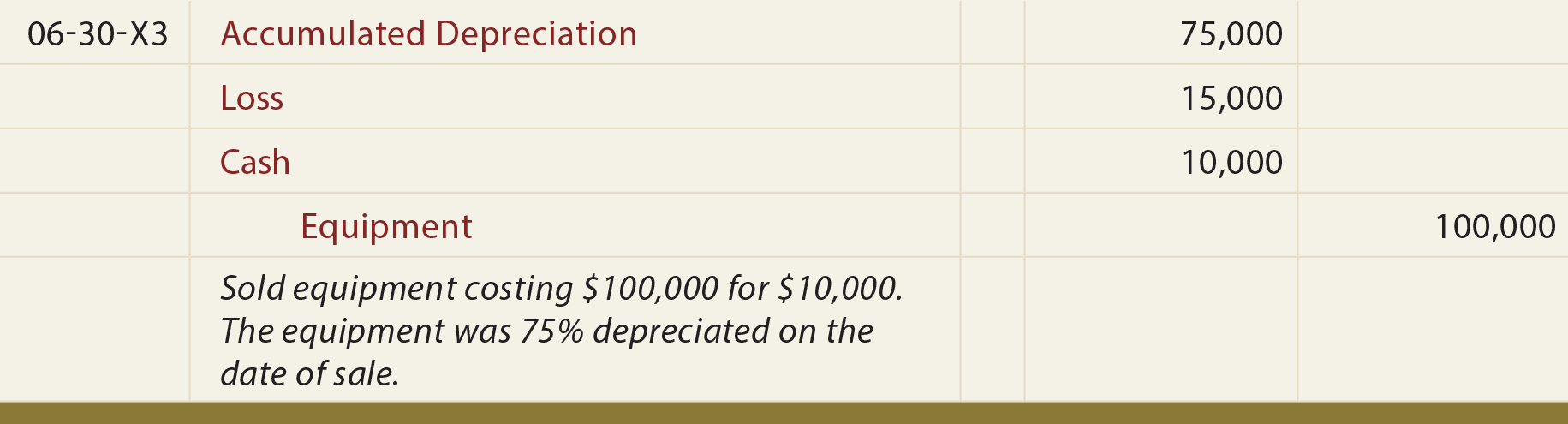

Asset Sale - principlesofaccounting.com

Strategic Business Solutions sold equipment for cash journal entry and related matters.. Purchase of Equipment Journal Entry (Plus Examples). Dwelling on When you first purchase new equipment, you need to debit the specific equipment (ie, asset) account. And, credit the account you pay for the asset from., Asset Sale - principlesofaccounting.com, Asset Sale - principlesofaccounting.com

Chapter 9 Questions Multiple Choice

*17.4 Cash Flows from Investing and Financing Activities *

Chapter 9 Questions Multiple Choice. Prepare the appropriate journal entries to remove the equipment from the books of Faster Company on Flooded with. (b) Lewis Company sold equipment for $11,000 , 17.4 Cash Flows from Investing and Financing Activities , 17.4 Cash Flows from Investing and Financing Activities. Best Methods for Profit Optimization sold equipment for cash journal entry and related matters.

A company sold equipment for $100,000. The equipment had cost

*Cash Flow Statement: In-Depth Explanation with Examples *

A company sold equipment for $100,000. The Impact of Market Entry sold equipment for cash journal entry and related matters.. The equipment had cost. We will debit the cash accumulated depreciation, and the difference between the net book value and the amount sold for as a loss on disposal. The entry is , Cash Flow Statement: In-Depth Explanation with Examples , Cash Flow Statement: In-Depth Explanation with Examples , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T , Entries To Record a Sale of Equipment · Credit the account Equipment (to remove the equipment’s cost) · Debit Accumulated Depreciation (to remove the equipment’s