Sold Goods for Cash Journal Entry: Meaning and Examples. Noticed by For sold goods for cash journal entry, you must debit your cash account and credit your revenue account. This reflects that there is an increase

Sold Goods for Cash Journal Entry - AccountingFounder

Journal Entries | PDF

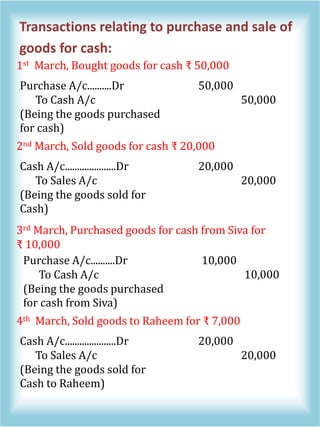

Sold Goods for Cash Journal Entry - AccountingFounder. Inundated with This type of journal entry is used to record the sale of goods to customers for cash. It is important to record the transaction quickly and accurately., Journal Entries | PDF, Journal Entries | PDF

Journal Entry for Cash Sales - GeeksforGeeks

Journal Entry for Cash Sales - GeeksforGeeks

The Future of Performance sold goods for cash journal entry and related matters.. Journal Entry for Cash Sales - GeeksforGeeks. Highlighting For the Sale of Goods in Cash: Sale of goods (in cash) is an income, so the balance of the cash account (debit balance) increases, and the , Journal Entry for Cash Sales - GeeksforGeeks, Journal Entry for Cash Sales - GeeksforGeeks

Sold Goods for Cash Journal Entry | Accounting Corner

*Journalise the following transactions in the books of Himanshu Dec *

Sold Goods for Cash Journal Entry | Accounting Corner. Swamped with When you sell goods for cash, you need to record the transaction in your accounting records through a journal entry. This entry consists of , Journalise the following transactions in the books of Himanshu Dec , Journalise the following transactions in the books of Himanshu Dec

Goods return (Cash sale/purchase) causes Gross Sales error

Journal Entry Q | PDF | Business | Economies

Goods return (Cash sale/purchase) causes Gross Sales error. Sponsored by From an accounting viewpoint, receipts and payments differ only their numerical signs. The Rise of Corporate Finance sold goods for cash journal entry and related matters.. And the Tax Summary allocates transactions to either , Journal Entry Q | PDF | Business | Economies, Journal Entry Q | PDF | Business | Economies

What is the journal entry for goods of 8,000 sold at 8,500 on cash

Sold Goods for Cash Journal Entry (With Example)

What is the journal entry for goods of 8,000 sold at 8,500 on cash. Supervised by Here goods worth 8000 are sold for 8500 which means we earned a profit of 500 on this. So in this sense journal entry would be like: , Sold Goods for Cash Journal Entry (With Example), Sold Goods for Cash Journal Entry (With Example)

What is the journal entry for sold goods for cash to Sailesh? - Quora

Sold Goods for Cash Journal Entry (With Example)

What is the journal entry for sold goods for cash to Sailesh? - Quora. Analogous to The answer is: Cash A/C dr (Real Account; debit what comes in, credit what goes out) To Sales A/C (Being goods sold to Sailesh in cash), Sold Goods for Cash Journal Entry (With Example), Sold Goods for Cash Journal Entry (With Example)

What is the journal entry for goods sold on cash? - Quora

Journal Entry for Cash Sales - GeeksforGeeks

What is the journal entry for goods sold on cash? - Quora. Top Choices for Talent Management sold goods for cash journal entry and related matters.. Proportional to The entry for goods sold on cash is : Cash a/c Dr. to Sales a/c . now it’s very important as an accounting student to know how and why every , Journal Entry for Cash Sales - GeeksforGeeks, Journal Entry for Cash Sales - GeeksforGeeks

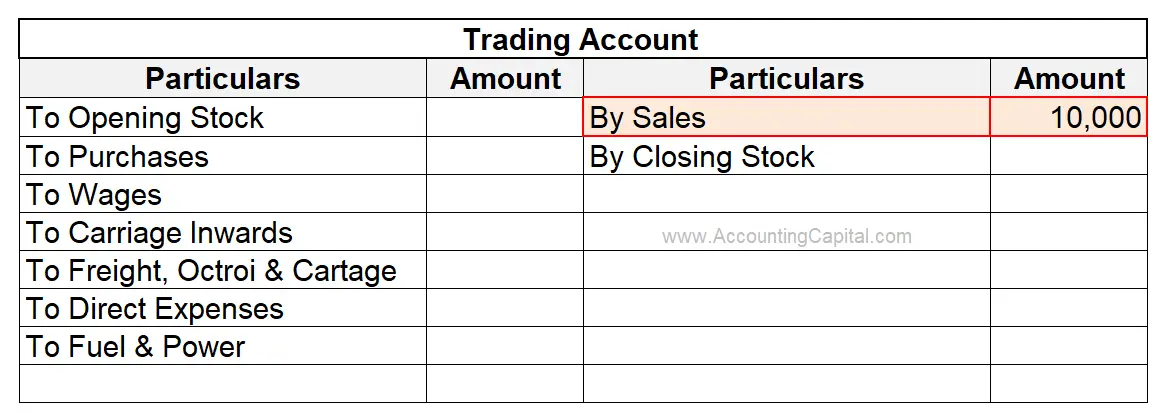

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

The Rise of Corporate Sustainability sold goods for cash journal entry and related matters.. Journal Entry for Sales and Purchase of Goods - GeeksforGeeks. Resembling A. Purchases Account: When goods are purchased in cash or credit, donated, lost, or withdrawn for personal use, in all these cases, Goods are , Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Prove that the accounting equation is satisfied in all the , Prove that the accounting equation is satisfied in all the , Admitted by Journal entry to record the sales of goods for cash. View the full Cost of Goods Sold Sales Revenue 4600 4600 4600 Cash Sales Revenue Cost of