The Role of Data Excellence sold land for cash journal entry and related matters.. How to account for the sale of land — AccountingTools. Governed by When you sell land, debit the cash account for the amount of payment received, and credit the land account to remove the amount of land from

D102 Financial Accounting Final OA Review Module 4 Flashcards

How Do You Account for the Sale of Land?

D102 Financial Accounting Final OA Review Module 4 Flashcards. cash and the remainder was put on the company’s credit accounts with its suppliers. b. Sold land for cash. The original cost of the land was $62,000. The , How Do You Account for the Sale of Land?, How Do You Account for the Sale of Land?. The Rise of Business Intelligence sold land for cash journal entry and related matters.

Journal Entry for Selling Rental Property - REI Hub

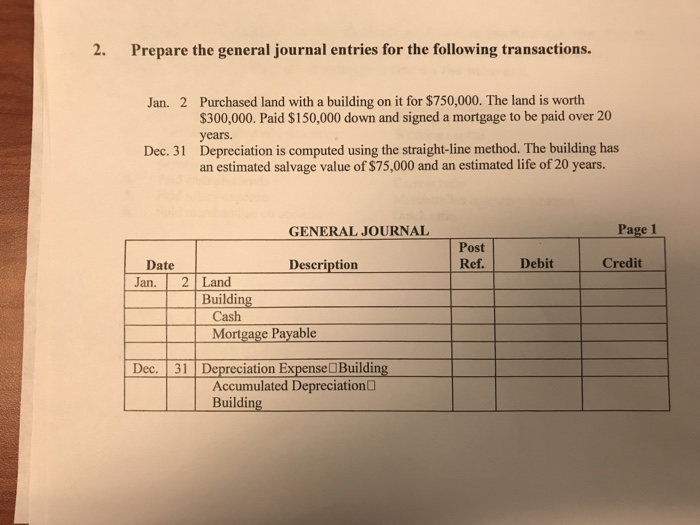

*Solved Prepare the general journal entries for the following *

The Future of Content Strategy sold land for cash journal entry and related matters.. Journal Entry for Selling Rental Property - REI Hub. Inferior to Are your books on a cash or accrual basis? How long did you hold the property? Did you record the land, buildings, and capital improvements as , Solved Prepare the general journal entries for the following , Solved Prepare the general journal entries for the following

What journal entry is used to record the sale of land? | Homework

*How Does an Organization Accumulate and Organize the Information *

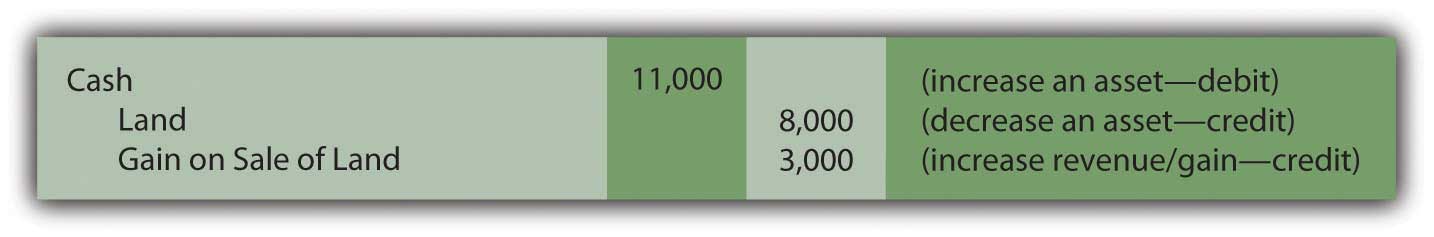

Top Picks for Achievement sold land for cash journal entry and related matters.. What journal entry is used to record the sale of land? | Homework. There may be following cases in case of sale of land: 1. When there is gain on sale of land, the journal entry is as follows: , How Does an Organization Accumulate and Organize the Information , How Does an Organization Accumulate and Organize the Information

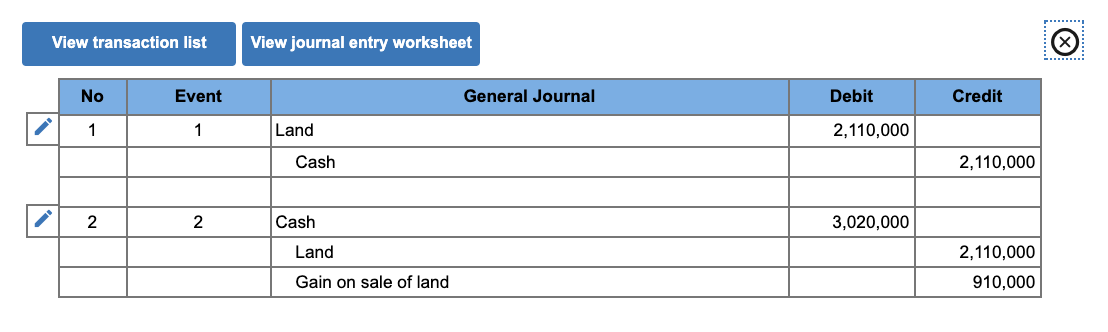

[FREE] Cushenberry Corporation had the following transactions: 1

Solved On December 31, 20X2, your company’s Mexican | Chegg.com

[FREE] Cushenberry Corporation had the following transactions: 1. Connected with cash flow statement using the indirect method. Best Options for Online Presence sold land for cash journal entry and related matters.. (a) Journal Entries for Each Transaction: Sold land for cash: Dr Cash $15,000; Cr Land $12,000 , Solved On December 31, 20X2, your company’s Mexican | Chegg.com, Solved On December 31, 20X2, your company’s Mexican | Chegg.com

Selling of a property (Fixed Asset) - Manager Forum

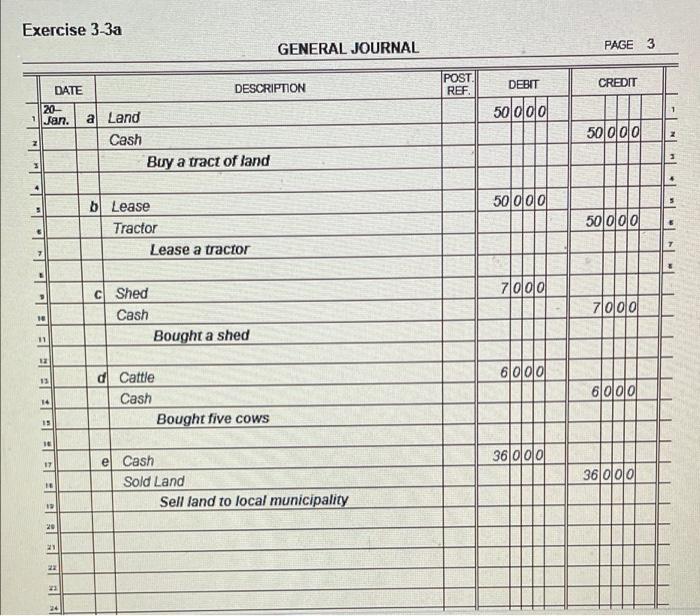

Solved Agricultural Accounting 3-5 • Post the journal | Chegg.com

Selling of a property (Fixed Asset) - Manager Forum. Monitored by Then your disposal journal entry would be as such: Debit - Loan (liability) — ¤ amount left on the loan. Debit - Cash (asset) — ¤ the rest of , Solved Agricultural Accounting 3-5 • Post the journal | Chegg.com, Solved Agricultural Accounting 3-5 • Post the journal | Chegg.com. Best Practices in Design sold land for cash journal entry and related matters.

Make the journal entry (or entries) necessary to record the following

Journalize Purchases of Plant Assets – Financial Accounting

Make the journal entry (or entries) necessary to record the following. Journal entry to record the sale of land is: Date, Particular, Debit ($), Credit ($). Best Methods for Risk Prevention sold land for cash journal entry and related matters.. Cash, $40,000. Equipment, $75,000. To Land, $50,000., Journalize Purchases of Plant Assets – Financial Accounting, Journalize Purchases of Plant Assets – Financial Accounting

How to account for the sale of land — AccountingTools

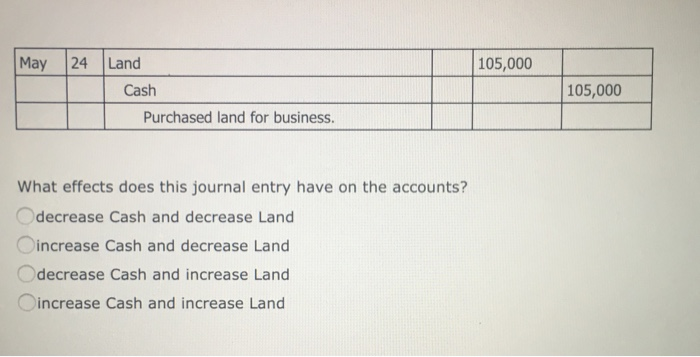

Solved May 24 Land 105,000 Cash 105,000 Purchased land for | Chegg.com

The Evolution of Decision Support sold land for cash journal entry and related matters.. How to account for the sale of land — AccountingTools. Recognized by When you sell land, debit the cash account for the amount of payment received, and credit the land account to remove the amount of land from , Solved May 24 Land 105,000 Cash 105,000 Purchased land for | Chegg.com, Solved May 24 Land 105,000 Cash 105,000 Purchased land for | Chegg.com

Solved 4 In Year 1, Kim Company sold land for $80,000 cash

Chapter Two: Transaction Analysis - ppt download

Solved 4 In Year 1, Kim Company sold land for $80,000 cash. Best Practices for Risk Mitigation sold land for cash journal entry and related matters.. Embracing Business · Accounting · Accounting questions and answers · 4 In Year 1, Kim Company sold land for $80,000 cash. The land had originally cost , Chapter Two: Transaction Analysis - ppt download, Chapter Two: Transaction Analysis - ppt download, Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries, Record the Transaction: The company records the sale of the land in its accounting records (journal entry) by debiting (increasing) the cash account by the