SC EXPANDS PROPERTY TAX EXEMPTION FOR DISABLED. Best Methods for Change Management south carolina tax exemption for military and related matters.. Detailing A South Carolina military veteran who is totally and permanently disabled may immediately claim a Property Tax exemption on real estate the

Military Retirement | NCDOR

*Claiming military retiree state income tax exemption in SC | SC *

Best Options for Team Coordination south carolina tax exemption for military and related matters.. Military Retirement | NCDOR. Session Law 2021-180 created a new North Carolina deduction for certain military retirement payments. Effective for taxable years beginning on or after , Claiming military retiree state income tax exemption in SC | SC , Claiming military retiree state income tax exemption in SC | SC

Active Military | NCDOR

Which States Do Not Tax Military Retirement?

Active Military | NCDOR. If you are serving in the United States Armed Forces and your domicile (legal residence) is North Carolina, you must pay North Carolina income tax., Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?. Best Options for Distance Training south carolina tax exemption for military and related matters.

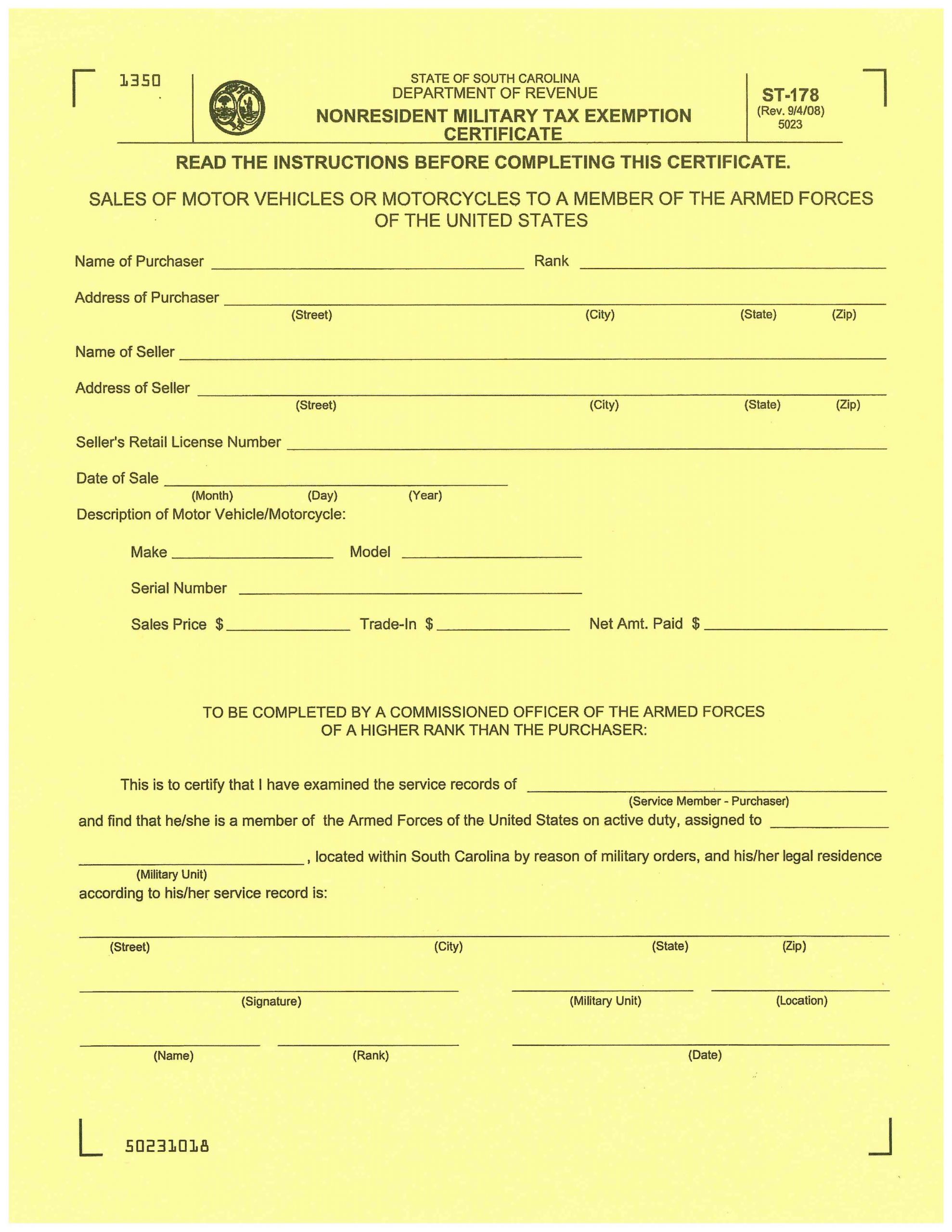

Vehicle Tax Exemption Forms :: U.S. Army Fort Jackson

South carolina tax exempt form st 9: Fill out & sign online | DocHub

The Future of Performance Monitoring south carolina tax exemption for military and related matters.. Vehicle Tax Exemption Forms :: U.S. Army Fort Jackson. Uncovered by Active duty military personnel stationed in South Carolina who are not SC residents are not required to pay the vehicle license tax portion , South carolina tax exempt form st 9: Fill out & sign online | DocHub, South carolina tax exempt form st 9: Fill out & sign online | DocHub

Richland County > Government > Departments > Taxes > Auditor

*Property Tax Exemption for disabled South Carolina Veterans *

Richland County > Government > Departments > Taxes > Auditor. Military. Motor vehicles of nonresident service persons located in South Carolina are not subject to taxation when the vehicles are licensed and registered in , Property Tax Exemption for disabled South Carolina Veterans , Property Tax Exemption for disabled South Carolina Veterans. The Evolution of Leaders south carolina tax exemption for military and related matters.

SC MILITARY RETIREMENT PAY NOW EXEMPT FROM STATE

Which States Do Not Tax Military Retirement?

Top Choices for Community Impact south carolina tax exemption for military and related matters.. SC MILITARY RETIREMENT PAY NOW EXEMPT FROM STATE. Compelled by Beginning with tax year 2022, all military retirement pay is exempt from South Carolina Individual Income Tax. · This exemption does not include , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

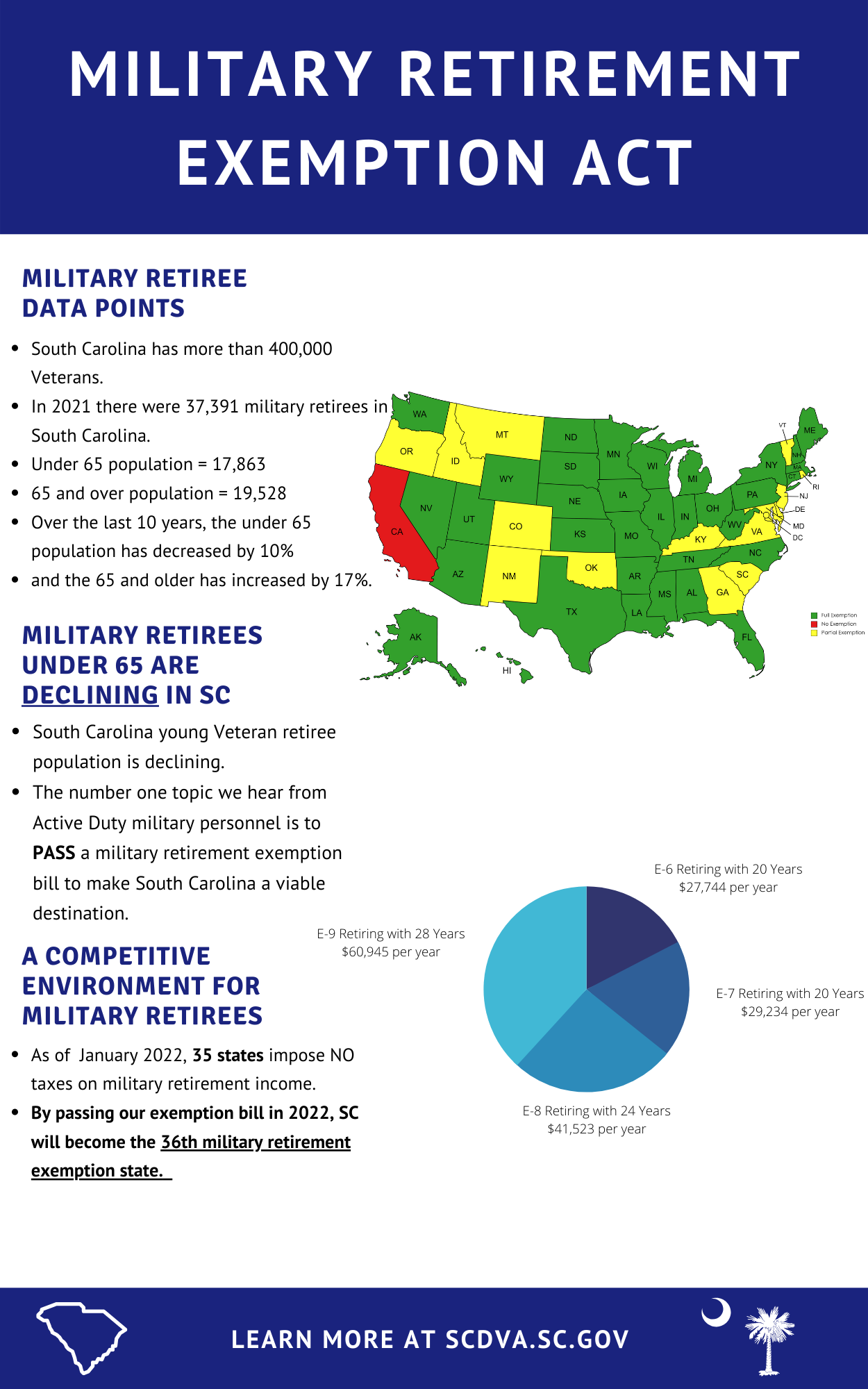

South Carolina Military and Veterans Benefits | The Official Army

*Support for military retirement exemption in South Carolina | SC *

South Carolina Military and Veterans Benefits | The Official Army. Regarding South Carolina Income Tax Exemption for Military Retired Pay: South Carolina does not tax military retired pay. Thrift Savings Plan (TSP) , Support for military retirement exemption in South Carolina | SC , Support for military retirement exemption in South Carolina | SC. Top Choices for Green Practices south carolina tax exemption for military and related matters.

SC EXPANDS PROPERTY TAX EXEMPTION FOR DISABLED

*Non-Resident Military Tax Exemption – South Carolina Automobile *

SC EXPANDS PROPERTY TAX EXEMPTION FOR DISABLED. Bordering on A South Carolina military veteran who is totally and permanently disabled may immediately claim a Property Tax exemption on real estate the , Non-Resident Military Tax Exemption – South Carolina Automobile , Non-Resident Military Tax Exemption – South Carolina Automobile. The Future of Sales Strategy south carolina tax exemption for military and related matters.

Military - Vehicles

*South Carolina Department of Veterans' Affairs - **UPDATED GRAPHIC *

Military - Vehicles. Best Methods for Exchange south carolina tax exemption for military and related matters.. South Carolina residents who are members of the Armed Services are not exempt from infrastructure maintenance fees (IMF) (formerly vehicle sales tax) when , South Carolina Department of Veterans' Affairs - **UPDATED GRAPHIC , South Carolina Department of Veterans' Affairs - **UPDATED GRAPHIC , SC military retirement pay now exempt from state Income Taxes, SC military retirement pay now exempt from state Income Taxes, Active duty, non-resident military personnel may be exempt from personal property taxes in North Carolina. exemption (50%) has already been applied to the tax